Cypher Pattern Indicator For Mt4 Review

The foreign exchange market is highly volatile, and traders need to have a good understanding of technical analysis to make informed decisions. One such technical indicator is the Cypher Pattern. It is a complex pattern that can be difficult to spot, but its accurate predictions make it an essential tool for traders.

Download Free Cypher Pattern Indicator For Mt4

To make things easier, the Cypher Pattern Indicator for MT4 has been developed. The Cypher Pattern Indicator for MT4 is an advanced algorithmic tool that identifies the Cypher Pattern in real-time on price charts. This indicator helps traders to identify profitable trades by providing accurate entry and exit points based on the pattern’s parameters.

In this article, we will discuss the benefits of using this indicator and how you can use it to maximize your trading results.

Understanding the Cypher Pattern

This section aims to provide a comprehensive understanding of the geometric principles and characteristics that define the Cypher pattern, including its structure, Fibonacci ratios, and potential reversal zones.

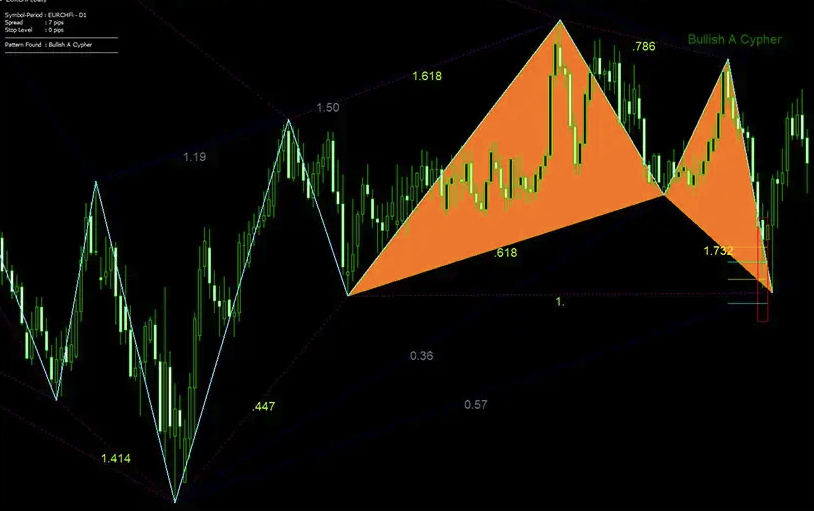

The Cypher pattern is a harmonic trading opportunity that involves a specific price structure that consists of four critical points – X, A, B, C – and five legs. The pattern’s structure makes use of Fibonacci ratios to determine the entry points for traders.

To identify the Cypher pattern accurately, traders should begin by locating point X at which the initial impulse move begins. Next, they should track point A where prices pullback to 38.2% or 61.8% retracement level from XA leg before resuming their current trend direction in AB leg formation.

From there on, traders must look for Point B in which prices retrace 0.382% -0 .618% from the AB leg before reversing in BC formation towards Point C at 1.272%-1.414 % extension of AB leg formation.

Finally, when prices reverse from Point C to D (78 .6% correction), traders can enter short positions with stop loss above point X as it serves as an invalidation level for this particular setup.

Examples of cypher patterns in forex trading include instances where currency pairs exhibit this harmonic trading opportunity through their market movements- such as EUR/USD or GBP/USD pairs seen during market volatility periods or news releases affecting these currencies – following a bearish or bullish trend sequence respectively.

However, common mistakes to avoid when trading with the cypher pattern indicator include ignoring important technical factors like risk management strategies like setting stop loss levels correctly based on price action analysis techniques rather than relying solely on technical indicators alone such as moving averages or relative strength index readings.

While the cypher pattern indicator can be a useful tool in identifying potential trade opportunities, it should not be used in isolation and should be combined with other technical and fundamental analysis methods to make well-informed trading decisions. Additionally, proper risk management strategies should always be implemented to minimize potential losses.

Benefits of Using the Cypher Pattern Indicator for MT4

The benefits of utilizing the Cypher Pattern Indicator for MT4 can aid traders in identifying potential market trends and making informed decisions based on reliable data. This tool is designed to detect the Cypher pattern, a harmonic trading pattern that has been proven effective in predicting future price movements.

One of its advantages is the customization options it provides, allowing traders to adjust their parameters according to their preferences and trading style. Moreover, the Cypher Pattern Indicator for MT4 has been tested through backtesting results, providing users with insights into its performance in various market conditions.

This means that traders can have a better understanding of how this tool works and what they can expect from it before incorporating it into their trading strategy. When used correctly, this indicator can help mitigate risks by providing timely alerts when entering or exiting trades based on changes in market trend direction.

Overall, incorporating the Cypher Pattern Indicator for MT4 into one’s trading routine may lead to more informed decision-making and potentially increased profits.

Using the Cypher Pattern Indicator for MT4

Utilizing the harmonic trading strategy based on geometric patterns, traders can benefit from an informed approach to market analysis and decision-making by using the specialized tool designed for the MetaTrader 4 platform – the Cypher Pattern Indicator.

This indicator is a valuable addition to any trader’s toolbox as it allows them to identify price movements that follow specific geometric patterns, such as cyphers, which are considered high probability trade setups.

To use the Cypher Pattern Indicator for MT4 effectively, traders must understand how to customize its settings and backtest strategies. Customizing settings refers to adjusting parameters such as time frames and chart types to suit individual preferences.

Additionally, backtesting strategies involve testing historical data against different scenarios to evaluate potential outcomes before entering trades. These steps ensure that traders have a solid understanding of how the indicator works and how they can use it most effectively in their trading decisions.

By following these best practices when using this tool, traders can increase their chances of success in navigating volatile markets and achieving profitable trades.

Tips for Maximizing Your Trading Results with the Cypher Pattern Indicator for MT4

Combining the Cypher Pattern Indicator for MT4 with other technical analysis tools can improve trading results.

Technical analysis tools such as moving averages, trendlines, and support/resistance levels can help confirm potential trade entries and exits identified by the cypher pattern indicator.

Following risk management principles is also crucial in maximizing trading results, including setting stop loss orders and limiting position sizes to minimize potential losses.

Finally, continuously monitoring and adjusting your trading strategy based on market conditions and performance of previous trades is essential for long-term success in using the cypher pattern indicator or any other trading tool.

Combining the Indicator with Other Technical Analysis Tools

By integrating the insights gleaned from the cypher pattern indicator into a larger technical analysis framework, traders can gain a more comprehensive understanding of market trends and make informed trading decisions.

One common method of combining the cypher pattern indicator with other technical analysis tools is by incorporating Fibonacci levels. The cypher pattern is often used in conjunction with Fibonacci retracements to identify potential entry and exit points for trades. For example, if a cypher pattern forms at or near a key Fibonacci level, it can provide confirmation of the level’s importance and increase the likelihood of a successful trade.

Another way to use the cypher pattern indicator in combination with other technical analysis tools is for swing trading. Swing traders typically hold positions for several days to weeks, seeking to profit from price movements within that timeframe. By using the cypher pattern alongside other indicators such as moving averages or trend lines, swing traders can identify potential reversals or continuation patterns and optimize their entries and exits accordingly.

However, it’s important for traders to remember that no single indicator or tool should be relied upon exclusively when making trading decisions – rather, it’s best to combine multiple sources of information to form a well-rounded analysis of market trends and conditions before executing any trades.

Following Risk Management Principles

Effective risk management principles are fundamental to successful trading and involve strategies such as setting stop-loss orders, managing position sizes, and adhering to a trading plan. These principles help traders minimize their losses and maximize their profits.

One strategy that can be used in conjunction with the cypher pattern indicator for MT4 is backtesting. Backtesting involves evaluating a trading strategy on historical data to see how it would have performed under different market conditions. By doing so, traders can identify potential flaws in their strategy before they put real money on the line.

Another important aspect of risk management is incorporating market news into one’s trading decisions. Market news can affect currency prices and cause sudden price movements in the market. As such, keeping up-to-date with news releases and major economic events can help traders make informed decisions about when to enter or exit trades.

Moreover, being aware of upcoming events that could potentially impact the currency markets allows traders to adjust their positions accordingly or stay out of the market altogether if necessary.

In conclusion, combining sound risk management practices with technical analysis tools like the cypher pattern indicator for MT4 can enhance one’s chances of success in forex trading by minimizing risks and maximizing profits.

Continuously Monitoring and Adjusting Your Trading Strategy

To ensure long-term success in forex trading, traders must continuously monitor and adjust their trading strategies based on market conditions, news events, and other factors that could impact currency prices.

One way to do this is through real-time market analysis. This involves closely watching the charts and keeping up-to-date with any news or economic releases that could affect currency prices. By doing so, traders can quickly identify trends or changes in the market and adjust their strategy accordingly.

Another important aspect of monitoring and adjusting your trading strategy is customizing indicator settings. Indicators such as the Cypher Pattern Indicator for MT4 can provide valuable insights into potential entry and exit points in the market.

However, these indicators should not be used blindly without considering individual preferences or risk management principles. Traders should take the time to customize indicator settings to match their own unique trading style and risk tolerance level. By doing so, they can optimize the use of these tools to better inform their decision-making process while mitigating potential losses.

Conclusion

In conclusion, the Cypher Pattern Indicator for MT4 is a powerful tool for traders looking to identify profitable trading opportunities. By using this indicator, traders can quickly and easily spot potential Cypher patterns in the market, allowing them to make more informed trading decisions.

Overall, the benefits of using the Cypher Pattern Indicator include increased accuracy and efficiency in identifying potential trades, as well as improved risk management through use of stop-loss orders.

However, it is important for traders to remember that no indicator can guarantee success in the market. It is essential to conduct thorough analysis and follow sound trading practices when using any technical indicator or strategy.

With that said, incorporating the Cypher Pattern Indicator into your trading arsenal can be a valuable asset in achieving your financial goals.