Contrarian Forex System Review

The foreign exchange (forex) market is one of the most volatile and complex financial markets in the world. With trillions of dollars traded daily, it can be difficult to predict market movements, as numerous factors such as economic data releases, political events, and investor sentiment can impact currency prices. Many traders employ various technical and fundamental analysis tools to make trading decisions. However, these tools are not always reliable, and some traders turn to contrarian strategies to gain an edge.

Contrarian forex trading involves taking positions that go against prevailing market trends or sentiment. This approach assumes that when the majority of traders are bullish on a particular currency pair, for example, there may be limited upside potential left in the trade.

Download Free Contrarian Forex System

Conversely, if most traders are bearish on a currency pair, then there may be opportunities for profit by taking a contrarian position. In this article, we will explore how to implement a contrarian forex system and best practices for success in this approach to trading.

Understanding Market Sentiment and Psychology

An important factor in trading is understanding market sentiment and psychology, as these can heavily influence price movements and ultimately impact the success of a trader.

Analyzing emotions is an essential component of this process, as emotions often drive market sentiment. Fear, greed, and optimism are emotions that can cause traders to act irrationally and create significant price movements.

Interpreting news is another critical aspect of understanding market sentiment. News releases can have a powerful effect on markets because they provide information that investors use to make decisions about buying or selling assets.

Positive news can lead to an increase in demand for a currency or other asset, while negative news may lead to a decrease in demand. Understanding how different types of news events affect markets is crucial for successful trading strategies based on contrarian forex systems.

Overall, interpreting market sentiment and psychology requires careful analysis of emotional factors and news events that impact investor behavior.

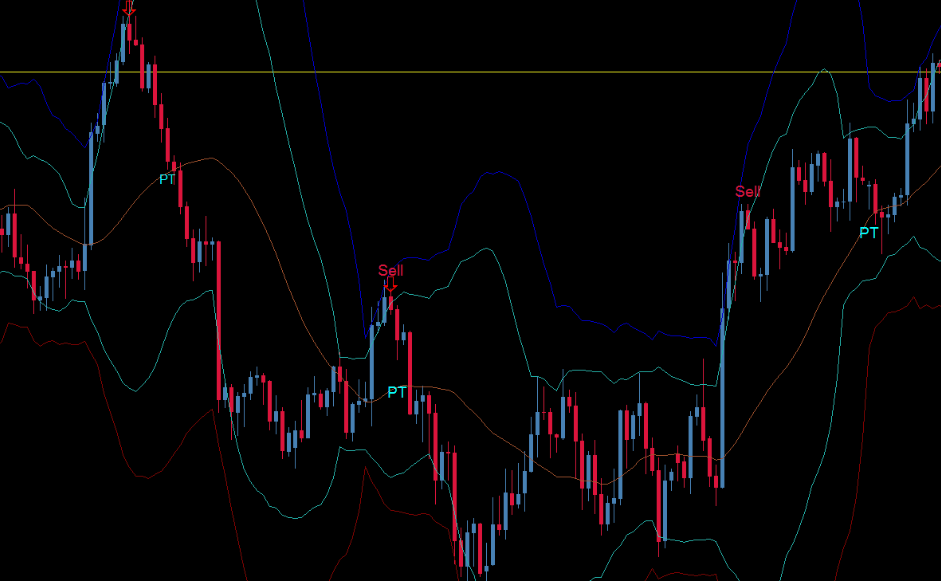

Implementing the Contrarian Forex System

The implementation of the contrarian forex system requires a careful consideration of risk management and the ability to accurately identify market trends. The approach involves going against the prevailing market sentiment, which can be challenging for most traders.

A contrarian trader should look for opportunities where the market is overreacting to news or events, leading to an exaggerated price movement that can be exploited.

To implement this strategy effectively, backtesting strategies are essential. This process involves testing historical data to determine whether a particular trading system would have been profitable in past markets. The backtesting process helps traders to identify weaknesses in their approach and refine their strategies before applying them in live markets.

When implementing a contrarian forex system, it is important to remain patient and disciplined while waiting for suitable entry points into positions as these will usually occur after significant market moves have taken place. By following this approach and adhering strictly to one’s trading plan, traders can increase their chances of success when using a contrarian forex system.

Best Practices for Success

To be successful in trading, it is important to have a solid understanding of risk management, market trends, and the ability to accurately identify opportunities that can be exploited for profit. With the Contrarian Forex System, traders need to be especially aware of these factors as it involves taking positions opposite to the prevailing trend. To maximize profits while minimizing losses, implementing effective risk management techniques is crucial. Traders should also backtest their strategies extensively on historical data to ensure that they are viable and profitable.

In addition to these key practices, there are several other best practices that traders should follow when using the Contrarian Forex System. These include:

- Maintaining discipline: It is essential for traders not to deviate from their trading plan or make impulsive decisions based on emotions.

- Monitoring news events: Major economic or political events can affect currency prices and potentially invalidate existing trades.

- Using stop-loss orders: Setting stop-loss orders at appropriate levels can limit losses if trades go against expectations.

By incorporating these best practices into their trading strategy, traders can enhance their chances of success when using the Contrarian Forex System.

Conclusion

Market sentiment and psychology play a crucial role in forex trading, and understanding them can help traders make informed decisions.

The Contrarian Forex System is an approach that goes against the prevailing market sentiment, aiming to capitalize on short-term price fluctuations. This system involves analyzing various indicators such as currency pair movements, economic news releases, and other technical data to identify potential trade opportunities.

To implement this strategy successfully, traders need to be patient, disciplined, and have a deep understanding of the market dynamics. They should also focus on risk management by setting stop-loss orders and limiting their exposure to high-risk trades. Additionally, it’s essential to keep abreast of global events that may impact the markets’ sentiment.

In conclusion, while the Contrarian Forex System may offer lucrative trading opportunities for savvy investors who are willing to go against the crowd, it’s important to note that no strategy guarantees success in forex trading.

As with any investment venture, careful research and analysis coupled with prudent risk management practices are key determinants of long-term profitability. Traders must remain vigilant and adapt their strategies accordingly based on market conditions.

By doing so consistently over time, they can increase their chances of achieving sustainable profits in the highly volatile world of forex trading.