Cobra Forex Scalping System Review

The world of forex trading is constantly evolving, with new strategies and systems emerging regularly.

One such system that has gained popularity in recent years is the Cobra Forex Scalping System. Developed by a team of experienced traders, this system aims to help traders make quick profits through short-term trades.

Download Free Cobra Forex Scalping System

The Cobra Forex Scalping System is based on technical analysis and price action, making use of various indicators to identify potential entry and exit points for trades. Additionally, it emphasizes the importance of money management principles to minimize risks and maximize profits.

While no trading strategy can guarantee success, understanding the concepts behind the Cobra Forex Scalping System may provide some insight into how successful traders approach their craft.

Overview of the Cobra Forex Scalping System

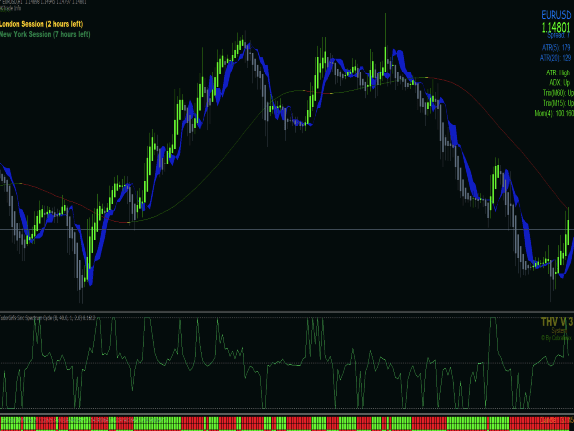

The current section provides a general overview of the trading strategy that is employed by the Cobra Forex Scalping System, including its key principles and characteristics. The system is designed to work on the 5-minute time frame and can be used to trade any currency pair. Its primary objective is to identify short-term price movements in the market and capitalize on them through quick trades.

One of the main advantages of the Cobra Forex Scalping System is its backtesting results, which have shown consistent profitability over a period of several years. Additionally, it offers traders a high degree of flexibility as it can be customized to suit individual preferences.

However, like any other trading system, it also has some limitations. For instance, given its focus on short-term trades, it may not be suitable for those who prefer long-term positions or are looking for more significant gains over extended periods. Furthermore, due to its reliance on technical indicators and chart patterns, it may not always perform optimally in rapidly changing market conditions or during news releases that trigger sharp price movements.

Technical Analysis and Price Action

By analyzing technical indicators and monitoring price action, traders can gain valuable insights into market trends and make informed decisions.

Technical analysis involves the use of various trading strategies to identify patterns in historical price data and predict future market movements. These strategies may include examining chart patterns, such as support and resistance levels, as well as using mathematical calculations to identify trends and momentum.

The Cobra Forex Scalping System incorporates a variety of technical indicators, including moving averages, Bollinger Bands, and MACD histograms. These tools help traders to identify potential entry and exit points for trades based on changes in price action.

Additionally, by closely monitoring the movement of prices over time, traders can better understand the underlying forces driving market trends and make more accurate predictions about future price movements.

Money Management Principles

Money management principles are essential to develop a successful trading strategy.

One of the key aspects is risk management, which involves strategies to mitigate potential losses and reduce overall risk exposure.

Position sizing helps traders determine the appropriate amount of capital to allocate for each trade, while setting stop losses and take profits can help manage risk and lock in profits.

Risk Management

Effective management of risk is crucial for any successful trading strategy, and this section provides valuable insights into the various techniques and tools that can be employed to minimize potential losses.

The first step in managing risk is conducting a thorough risk assessment before entering a trade. This involves analyzing market conditions, assessing potential risks, and determining an appropriate stop-loss level. Traders should also consider the size of their trading account when setting stop-loss levels to ensure that they do not exceed their maximum acceptable loss per trade.

Trading psychology plays a crucial role in effective risk management as well. Emotional decision-making often leads to irrational decisions and impulsive trades, which can result in significant losses. To avoid this, traders must have a disciplined approach to trading and stick to their pre-determined risk management strategies.

Additionally, it’s essential to understand that losses are inevitable in trading; therefore, traders must learn how to accept them without letting them impact their future decisions negatively. Employing tools like trailing stops or partial position closing can also help limit potential losses while allowing profitable trades to run their course.

Position Sizing

The current section delves into the importance of position sizing in trading, which involves determining the appropriate amount of capital to allocate to a given trade based on factors such as risk tolerance, market volatility, and potential returns. Position sizing is an essential component of any trading strategy as it helps traders maximize profits while minimizing losses. It involves calculating the size of a trade relative to account size and defining stop loss levels for each position.

Position sizing can be approached in several ways, including fixed fractional position sizing and fixed dollar position sizing. Fixed fractional position sizing involves allocating a percentage of total account equity to each trade, while fixed dollar position sizing entails risking a specific dollar amount per trade. Both methods have their advantages and disadvantages; however, choosing the right approach depends on individual preferences and risk tolerance. The table below illustrates some key considerations when selecting a position-sizing method.

| Method | Advantages | Disadvantages |

|---|---|---|

| Fixed Fractional Position Sizing | Limits drawdowns by reducing risk with smaller positions | Can lead to missed opportunities due to smaller trades |

| Fixed Dollar Position Sizing | Enables consistent risk management regardless of account size | May increase drawdowns during losing streaks |

Ultimately, successful traders employ effective techniques for managing their positions within their overall trading strategies. By utilizing sound principles of risk management through proper positioning sizing techniques, traders can better control their risks and ultimately achieve long-term success in the markets.

Setting Stop Losses and Take Profits

Setting appropriate stop losses and take profits is an essential part of any trading strategy, including the cobra forex scalping system. While position sizing determines the amount of risk taken in each trade, setting stop losses and profit targets ensures that traders exit their positions at predetermined levels to manage their risk effectively.

One popular method for managing trades in the cobra forex scalping system is using a trailing stop, which adjusts the stop loss level as the price moves in favor of the trade.

Traders can set their profit targets based on several factors such as support and resistance levels, chart patterns, or technical indicators. To determine an appropriate profit target for each trade, traders should consider their risk-reward ratio and ensure that they are taking enough profit relative to their potential loss.

Additionally, some traders may choose to use multiple profit targets to take partial profits along the way while keeping a portion of their position open to capture further gains.

By incorporating proper stop loss and profit-taking strategies into their trading plan, cobra forex scalpers can enhance their chances of success while minimizing risks.

Tips for Successful Implementation

To ensure a smooth and efficient implementation of the cobra forex scalping system, traders should take note of the following tips.

First, it is crucial to maintain discipline and follow a trading plan consistently. Traders should avoid making impulsive decisions based on emotions or market noise. Trading psychology plays a significant role in determining one’s success in the market, so it is essential to have a clear mind and stick to predetermined entry and exit points.

Secondly, traders must keep an eye on market volatility when using the cobra forex scalping system. Volatility can impact trade outcomes significantly; therefore, traders need to adjust their strategies accordingly. Maintaining awareness of news events that could cause significant price movements is also crucial.

It is worth noting that high volatility does not necessarily mean higher profits as it may lead to more false signals or whipsaws during trades.

In summary, implementing these tips will help traders achieve better results when using this scalping technique by reducing unnecessary risks and increasing profitability over time.

Conclusion

The Cobra Forex Scalping System is a popular trading strategy among traders who prefer short-term trades. It involves technical analysis and price action with the aim of making numerous small profits. The system relies on indicators such as moving averages, stochastic oscillators, and the RSI to identify potential entry and exit points.

Proper money management principles are crucial when using this system to ensure that losses are limited while profits are maximized. To successfully implement the Cobra Forex Scalping System, traders must be disciplined and patient. They should avoid overtrading and stick to their strategy even during periods of market volatility.

Traders should also keep track of their progress by maintaining a trading journal that includes details about each trade they make. Overall, the Cobra Forex Scalping System can be a profitable trading strategy if implemented correctly. However, traders must understand that there is no guarantee for success in the forex market, and losses may occur despite following a well-planned strategy.

It is essential for traders to continuously educate themselves on market developments and seek advice from experienced professionals before making any decisions regarding their investments.