Choppy Market Index For Mt4 Review

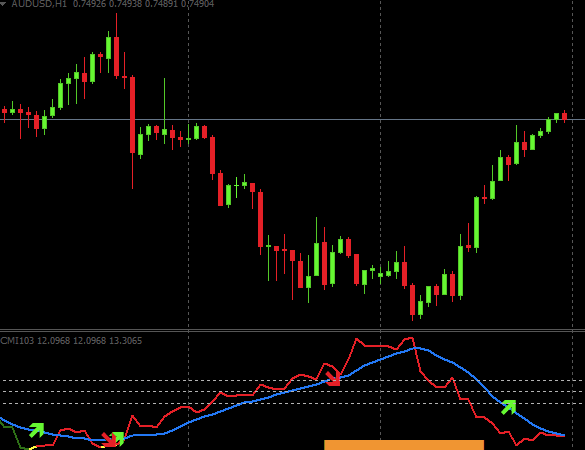

The Choppy Market Index (CMI) is a technical indicator that has been developed to help traders identify market conditions that are indicative of a choppy or ranging market.

The CMI was developed by Australian trader and author, Erol Bortucene, who believed that the traditional indicators such as moving averages and oscillators were not effective in identifying whether the market was trending or trading sideways.

Download Free Choppy Market Index For Mt4

The CMI uses a mathematical formula to calculate the extent of price oscillations within a given period. It measures the difference between the highest high and lowest low prices over a specified number of periods and compares it with the average true range (ATR) over those same periods.

A higher value indicates greater volatility in price movements, while a lower value indicates relatively stable price action. In this article, we will explore how traders can use the CMI to improve their trading decisions in different market conditions.

What is the Choppy Market Index?

This section provides an explanation of a quantitative indicator that is used to identify market conditions in which price movements are limited and lack direction, otherwise known as the Choppy Market Index.

This indicator helps traders recognize when the market is moving sideways or in a range-bound manner, instead of trending up or down. The choppy market index can be helpful for both short-term and long-term traders who want to adjust their strategies based on current market conditions.

The calculation method for the choppy market index involves measuring the difference between the highest high and lowest low over a specified period of time. Historical performance can be used to determine what values are appropriate for different markets.

For example, if historical data shows that a particular market tends to be more volatile than others, it may require a wider range for choppy market conditions to be identified. Overall, the choppy market index can provide valuable information for traders looking to make informed decisions during periods of low volatility and sideways movement in the markets they follow.

How Can Traders Use the Choppy Market Index?

Identifying turbulent market conditions is crucial for traders to make informed trading decisions. The choppy market index for MT4 is a technical indicator that can help identify whether the market is in a state of turbulence or not.

By analyzing this indicator, traders can adjust their strategies and risk management techniques accordingly to optimize their trading performance in choppy markets.

Identifying Turbulent Market Conditions

The section focuses on the identification of conditions that exhibit high levels of volatility and unpredictability, which can pose a challenge for traders seeking to make informed investment decisions.

Market volatility indicators are essential tools that traders use to identify turbulent market conditions. These indicators measure the extent of price fluctuations in a market and help traders gauge the level of uncertainty in the market.

Some commonly used volatility indicators include Average True Range (ATR), Bollinger Bands, and Relative Strength Index (RSI).

Trading strategies for choppy markets require astute analysis and careful risk management. One strategy is to reduce trade frequency by using longer time frames, such as daily or weekly charts, which are less susceptible to short-term price fluctuations.

Another approach is to use stop-loss orders, which help limit potential losses by automatically closing a position when prices move beyond predetermined levels.

Additionally, traders may opt for hedging strategies using options or futures contracts that provide protection against adverse price movements. By staying alert to choppy market conditions and employing appropriate trading strategies, traders can navigate volatile markets more effectively and mitigate the risks associated with sudden price swings.

Making Informed Trading Decisions

In order to make informed trading decisions, it is important for traders to have a thorough understanding of market conditions and use reliable data sources to analyze trends and patterns in price movements.

One way to do this is by using the choppy market index for MT4, which measures market volatility based on changes in price movements over a specific time period. This tool can be particularly useful for identifying periods of high turbulence or choppiness in the market, which can signal potential risks or opportunities.

By analyzing trends and patterns in price movements using the choppy market index, traders can gain a better understanding of how different factors are affecting the market and make more informed trading decisions.

For example, if the index shows that the market is experiencing high levels of turbulence or volatility, traders may want to exercise caution and consider adjusting their strategies accordingly. On the other hand, if the index indicates relatively stable conditions with minimal fluctuations in price movements, traders may feel more confident taking certain risks or making trades with higher potential payouts.

Ultimately, by staying up-to-date on changing market conditions and using reliable data sources like the choppy market index for MT4, traders can improve their chances of success in today’s fast-paced financial markets.

Tips for Using the Choppy Market Index Effectively

Choosing the right timeframe is crucial when using the choppy market index. Traders should select a timeframe that aligns with their trading strategy and risk tolerance.

Combining the choppy market index with other indicators can improve its effectiveness in identifying trend reversals and confirming signals.

Finally, it is essential to monitor market conditions regularly to ensure the indicator continues to provide accurate signals.

Choosing the Right Timeframe

Selecting an appropriate timeframe is essential for effectively navigating fluctuating market conditions to optimize trading strategies.

The choppy market index (CMI) is a popular indicator used by traders to identify sideways markets, which can be challenging to trade as they lack clear trends.

However, using the CMI alone may not be sufficient for accurate market analysis, and combining it with other best indicators and market analysis techniques can enhance its effectiveness.

When selecting the right timeframe for utilizing the CMI, traders should consider their preferred trading style and risk tolerance levels.

Short-term traders may prefer shorter timeframes such as 5-minute or 15-minute charts, whereas long-term traders may opt for daily or weekly charts.

Additionally, traders should also evaluate historical data to determine how frequently choppy markets occur in specific timeframes and adjust their strategy accordingly.

Another consideration is incorporating multiple timeframes into their analysis to gain a broader perspective on market trends and potential opportunities.

By carefully selecting the appropriate timeframe(s), traders can maximize the use of CMI in identifying optimal entry and exit points in choppy markets.

Combining with Other Indicators

By incorporating additional technical analysis indicators and market analysis techniques, traders can enhance the effectiveness of their trading strategies when navigating fluctuating market conditions.

One approach is to combine choppy market index (CMI) with oscillators such as the relative strength index (RSI). These two indicators complement each other well as CMI helps identify periods of low volatility while RSI signals overbought or oversold conditions.

By using both indicators, traders can better time their entries and exits in the market. Implementing CMI in automated trading systems also allows for more efficient decision making in choppy markets.

The use of algorithms and programming language can automatically execute trades based on pre-set parameters that consider various factors including CMI readings. This not only saves time but also minimizes human error and emotion-based decisions that could negatively impact profitability.

However, it is important to note that automated trading should still be monitored regularly by traders to ensure its effectiveness and adjust settings as needed.

Monitoring Market Conditions Regularly

To effectively navigate fluctuating market conditions, traders must regularly monitor the current state of the market and adjust their trading strategies accordingly, as failure to do so could result in missed opportunities or significant losses.

Tracking volatility is a crucial aspect of monitoring market conditions as it helps traders identify potential trends and changes in the market that can affect their investment decisions.

There are various market analysis techniques that traders can use to track volatility such as Bollinger Bands, Moving Average Convergence Divergence (MACD), Relative Strength Index (RSI), and the Choppy Market Index (CMI) for MT4.

The CMI for MT4 is particularly useful in choppy markets where prices tend to oscillate without any clear direction. This indicator measures the percentage of bars that have closed within a certain range over a specified period and provides traders with an indication of whether the market is trending or moving sideways.

By incorporating this indicator into their trading strategies, traders can avoid making impulsive decisions based on false signals and instead wait for more reliable indicators before entering or exiting trades.

Regularly monitoring different aspects of the market, including tracking volatility with tools like CMI for MT4, can help traders stay informed about changes in market conditions and better manage risk while maximizing profit potential.

Conclusion

The Choppy Market Index is a technical indicator that traders can use to identify periods of market indecision or choppiness.

By analyzing the ratio of the average true range (ATR) to the total price movement over a certain period, the Choppy Market Index helps traders determine whether the market is trending or trading sideways.

Traders can use this information to adjust their strategies accordingly.

During choppy markets, for example, traders may choose to adopt range-bound strategies rather than trend-following ones.

Additionally, they may opt for shorter-term trades with smaller profit targets and tighter stop-loss orders.

Overall, the Choppy Market Index is a useful tool for traders looking to gain an edge in volatile markets.

By providing insight into market conditions and helping traders make informed decisions about their trades, this indicator can be instrumental in achieving long-term success in trading.