Cci Rsi Index Indicator For Mt4 Review

Technical analysis is an essential aspect of forex trading, and traders require indicators that provide timely insights into market trends and price movements.

The Commodity Channel Index (CCI) and Relative Strength Index (RSI) are popular indicators used by traders to identify overbought or oversold conditions in the market.

The CCI measures the difference between the current price and its average deviation, while the RSI calculates the strength of a security’s price changes.

Download Free Cci Rsi Index Indicator For Mt4

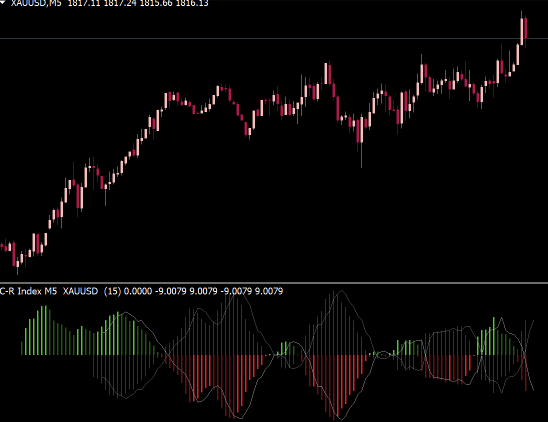

The CCI RSI Index Indicator for MT4 combines these two powerful indicators to provide a comprehensive view of market trends and signals potential entry or exit points.

This article will explore how the CCI RSI Index Indicator works, its features, customization options, and benefits for forex traders looking to improve their technical analysis capabilities.

Understanding the Commodity Channel Index (CCI) and Relative Strength Index (RSI)

In this section, we will gain an understanding of two popular technical analysis tools used in financial markets – the Commodity Channel Index (CCI) and Relative Strength Index (RSI).

The CCI is a momentum oscillator that measures the variation of an asset’s price from its statistical average. It is primarily used to identify overbought or oversold conditions in the market and generate buy or sell signals.

On the other hand, RSI is another momentum oscillator that measures the strength of an asset’s recent price movements compared to its previous losses and gains. It ranges between 0 and 100, with values above 70 indicating overbought conditions and values below 30 indicating oversold conditions.

Compared to other technical indicators, CCI RSI index indicator provides traders with valuable insights into market trends and potential entry or exit points for trades. However, it also has certain limitations and drawbacks that must be considered when using it in trading decisions.

For instance, both tools are sensitive to sudden price fluctuations, which can cause false signals during periods of high volatility. Additionally, relying solely on these indicators without considering other factors such as fundamental analysis may not provide a comprehensive picture of market trends.

Therefore, traders must exercise caution when using CCI RSI index indicator as part of their trading strategy and consider combining it with other technical indicators for better accuracy in predicting future market trends.

Features and Customization Options of the CCI RSI Index Indicator for MT4

To discuss the features and customization options of the CCI RSI Index Indicator for MT4, we will cover how to install the indicator.

Additionally, we will examine customization options specific to individual trading strategies.

Finally, we will provide examples of how traders can use this indicator in their trading activities.

How to install the indicator

The installation process for the CCI RSI index indicator involves several steps that require an understanding of the file structure within the MetaTrader 4 platform and familiarity with the process of adding custom indicators to a chart.

Firstly, traders need to download the CCI RSI index indicator file from a reliable source and save it on their computer.

Next, they should open their MT4 platform, click on ‘File’ in the top left corner, and select ‘Open Data Folder.’

A new window will appear showing all folders related to the MT4 platform. Traders should go to MQL4 > Indicators folder, paste or drag-and-drop the CCI RSI index file into this folder.

After completing these steps, traders can restart their MT4 platform or refresh their Navigator window under ‘Indicators’ by right-clicking and selecting ‘Refresh.

The CCI RSI index indicator should now be visible in the list of available indicators under ‘Custom Indicators.’

However, common errors during installation include copying files into incorrect folders or not restarting/refreshing MT4 after completing installation.

Troubleshooting tips for these errors involve verifying that files are copied into correct folders and ensuring that MT4 is restarted/refreshed before using any custom indicators on charts.

Customization options for individual trading strategies

Customizing trading strategies can be a vital aspect of successful trading, and this section explores the various options available for traders to tailor their approach using the CCI RSI index indicator.

Advanced trading strategies involve combining multiple technical analysis techniques to create a more comprehensive approach to market analysis. The CCI RSI index indicator can be used in conjunction with other indicators, such as moving averages or Bollinger Bands, to refine the signals generated and improve accuracy.

Traders may also adjust the settings of the CCI RSI index indicator based on their individual preferences and risk tolerance. For example, increasing the period length of the indicator may result in fewer but more reliable signals, while decreasing it could generate more frequent but less accurate signals.

Additionally, traders may choose to use different levels for overbought and oversold conditions depending on their interpretation of market conditions. Overall, customizing trading strategies with the CCI RSI index indicator allows traders to adapt to changing market conditions and improve their chances of success.

Examples of how to use the indicator in trading

This section provides insight into the practical application of the CCI RSI index indicator in trading scenarios, offering examples of how traders can utilize this technical analysis tool to identify potential entry and exit points, as well as manage risk and optimize profits.

In real-life trading scenarios using the CCI RSI Index Indicator, traders typically use it to identify overbought and oversold conditions in price trends. When the indicator reaches extreme levels (above +100 or below -100), it is considered a signal for a potential reversal in trend direction. Traders may then use this information to enter or exit positions accordingly.

Additionally, backtesting results and statistical analysis of the indicator’s effectiveness in trading have shown that when used in conjunction with other technical analysis tools, such as moving averages or trend lines, the CCI RSI Index Indicator can significantly improve a trader’s overall profitability.

By incorporating this indicator into their trading strategy, traders can effectively manage risk by placing stop-loss orders based on the indicator’s signals and optimize profits by taking advantage of high-probability trade setups identified by the tool.

Overall, understanding how to use the CCI RSI Index Indicator can be a valuable asset for any trader looking to enhance their technical analysis skills and achieve greater success in their trades.

Benefits of Using the CCI RSI Index Indicator for MT4

Improved accuracy in identifying trends and potential entry and exit points is one of the major benefits of using the CCI RSI Index Indicator for MT4.

This indicator combines two popular technical indicators, the Commodity Channel Index (CCI) and Relative Strength Index (RSI), to provide a more comprehensive view of market conditions.

Additionally, traders can save time by using this indicator as it simplifies analysis by providing clear signals on potential entry and exit points, making it suitable for both beginners and experienced traders alike.

Improved accuracy in identifying trends and potential entry and exit points

The section focuses on enhancing the precision of trend identification and determining opportune entry and exit points using the CCI RSI Index Indicator for MT4.

This technical analysis tool is widely used by traders to identify overbought or oversold conditions in a market. It measures the current price level relative to its average price level over a given time period, which enables traders to determine if an asset is undervalued or overvalued.

One of the practical applications of this indicator is its ability to identify trends accurately. Traders can use it as a confirmation tool alongside other indicators such as moving averages or trendlines.

When the CCI RSI Index Indicator shows an uptrend, it suggests that prices are increasing at a faster rate than their historic average, indicating bullish momentum. Conversely, when it indicates a downtrend, prices are falling at a quicker pace than their historical average, signaling bearish momentum.

However, like any other technical analysis tool, the CCI RSI Index Indicator has limitations and drawbacks that traders should be aware of before using it solely for trading decisions.

Time-saving in analyzing market conditions

By utilizing a technical analysis tool to analyze market conditions, traders can save valuable time and effort in determining the most opportune entry and exit points based on the current price level relative to historical averages.

The cci rsi index indicator for MT4 is one such tool that helps traders make informed decisions in a timely manner. This indicator plots two oscillators – Commodity Channel Index (CCI) and Relative Strength Index (RSI) – on the same chart, thereby providing a comprehensive view of market trends.

Efficiency in market analysis is crucial for busy traders who want to optimize their trading strategies while minimizing their time commitment. The cci rsi index indicator for MT4 simplifies this process by providing clear signals when a security is overbought or oversold, indicating potential reversal points.

Additionally, it helps traders identify trend changes early on, allowing them to take advantage of profitable opportunities before other traders catch on. By incorporating this technical analysis tool into their trading routine, traders can streamline their decision-making process and focus on executing trades with precision and confidence.

Suitable for both beginners and experienced traders

This technical analysis tool can be utilized by traders of all levels, from novices to seasoned professionals, in order to simplify the market analysis process and identify profitable opportunities with ease.

The CCI RSI Index Indicator is designed to provide a comprehensive view of market conditions by combining two popular indicators – the Commodity Channel Index (CCI) and the Relative Strength Index (RSI). Traders can use this indicator to analyze price trends, momentum, and volatility across different timeframes.

Trading psychology considerations for using the CCI RSI Index Indicator may include managing emotions such as fear or greed that can impact decision-making. Traders should also have a solid understanding of technical analysis concepts and use proper risk management strategies when implementing this indicator into their trading plan.

Backtesting strategies for evaluating the performance of the CCI RSI Index Indicator involve testing it on historical data to assess its effectiveness in identifying profitable trades. This helps traders gain confidence in using this tool before applying it to live trading accounts.

Overall, the accessibility and versatility of this indicator make it an attractive option for both beginners and experienced traders seeking a simplified approach to market analysis.

Conclusion

In conclusion, the CCI RSI Index Indicator for MT4 is a powerful tool that traders can use to analyze market trends and make informed decisions. Understanding the Commodity Channel Index (CCI) and Relative Strength Index (RSI) is essential to effectively utilizing this indicator.

The CCI measures the deviation of an asset’s price from its statistical average, while the RSI identifies overbought or oversold conditions. With customizable features such as color schemes and period settings, the CCI RSI Index Indicator for MT4 provides flexibility for traders to tailor it to their specific needs.

By using this indicator, traders can benefit from identifying potential entry and exit points in the market. Overall, incorporating the CCI RSI Index Indicator into one’s trading strategy can help improve accuracy and profitability in forex trading.