Cci Double Ema Indicator For Mt4 Review

Technical analysis is an important tool for traders in the financial markets, and indicators play a crucial role in analyzing price movements.

One such indicator is the Commodity Channel Index (CCI), which measures the variation of price from its statistical mean.

Download Free Cci Double Ema Indicator For Mt4

Another popular indicator is the Exponential Moving Average (EMA), which smoothes out price movements over a period of time.

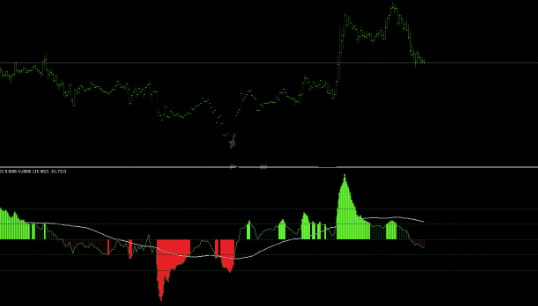

Combining these two indicators results in the CCI Double EMA Indicator, which helps traders identify trend reversals and potential entry and exit points.

The CCI Double EMA Indicator uses two EMAs to filter out noise and determine market trends.

When prices are above both EMAs, it suggests a bullish market; when prices are below both EMAs, it suggests a bearish market.

Additionally, when the CCI crosses above or below zero, it indicates potential buying or selling opportunities respectively.

The CCI Double EMA Indicator can be used on any financial instrument that has sufficient trading volume and liquidity.

With proper understanding and application, this indicator can provide valuable insights into market trends for successful trading strategies.

Understanding the Commodity Channel Index (CCI) and Exponential Moving Average (EMA)

This section provides an explanation of the Commodity Channel Index (CCI) and Exponential Moving Average (EMA) and their relevance in technical analysis.

The CCI is a momentum-based oscillator used to measure the strength of price action, while the EMA is a type of moving average that places greater weight on recent data points.

In combination, these two indicators can provide valuable insights into market trends and potential trading opportunities. While the CCI and EMA are commonly used in technical analysis to identify buy and sell signals in financial markets, they can also be useful for non-trading purposes.

For example, investors may use these indicators to track market trends over time or as part of a broader investment strategy. Additionally, the CCI and EMA are not limited to just one financial market; they can be applied across a range of asset classes, including stocks, bonds, currencies, and commodities.

Overall, understanding how these tools work together can help traders make more informed decisions about when to enter or exit positions based on market conditions.

How to Use the CCI Double EMA Indicator for Trading

The following section outlines a comprehensive guide on how to effectively utilize the CCI Double EMA indicator in trading, including key strategies and techniques for maximizing its potential.

The CCI Double EMA Indicator is a trend-following technical analysis tool that uses two exponential moving averages (EMA) of different periods along with the Commodity Channel Index (CCI). The combination of these indicators helps traders identify significant trends and potential trend reversals.

Using the CCI Double EMA Indicator for Trend Trading involves monitoring the direction and strength of the trend. When the price is trending upwards, both EMAs will be pointing upwards, providing a bullish signal. Conversely, when the price is trending downwards, both EMAs will be pointing downwards, providing a bearish signal. Additionally, traders can use the CCI to confirm momentum by checking whether it stays above or below zero during an uptrend or downtrend respectively.

Identifying Trend Reversals with the CCI Double EMA Indicator involves looking for divergences between price action and indicator readings. A bullish divergence occurs when prices make lower lows while the indicator makes higher lows; this could indicate that buyers are coming into control of the market. On the other hand, a bearish divergence occurs when prices make higher highs while indicators make lower highs; this could indicate that sellers are coming into control of the market.

Tips for Maximizing Your Trading Success with the CCI Double EMA Indicator

Setting stop losses and take profits is crucial when using the CCI Double EMA Indicator to maximize trading success, as it helps manage risk and lock in profits.

Pairing the indicator with other technical analysis tools such as trend lines and support/resistance levels can provide additional confirmation for trade entries and exits.

Common mistakes to avoid when trading with the CCI Double EMA Indicator include over-reliance on signals from the indicator alone without considering other market factors, placing trades solely based on divergences without confirming them with other indicators or price action, and failing to adjust settings based on different market conditions or timeframes.

Setting Stop Losses and Take Profits

A crucial aspect of successful trading is determining appropriate levels for stop losses and take profits when using the CCI Double EMA Indicator. Stop loss orders are essential in managing risk, as they limit potential losses in case the trade goes against you. Setting a stop loss too tight may result in getting stopped out prematurely, while setting it too wide may expose you to unnecessary risk. The key is to find a balance between limiting your downside and giving your trades enough room to maneuver.

Take profit orders are equally important, as they help secure profits once the price reaches a certain level. This helps traders avoid holding onto positions for too long, which can lead to losing gains or even turning profitable trades into losing ones.

However, determining where to set take profit levels can be challenging since it requires an understanding of market conditions and technical analysis. By incorporating fundamental analysis with the CCI Double EMA Indicator, traders can make more informed decisions about their stop loss and take profit levels, leading to better risk management strategies and potentially higher profitability.

Pairing the Indicator with Other Technical Analysis Tools

Integrating the CCI Double EMA Indicator with additional technical analysis tools can provide traders with a comprehensive understanding of market trends, allowing for more accurate predictions and informed decision-making.

Technical analysis benefits include identifying patterns and trends in price movements, providing entry and exit points for trades, and helping to set appropriate stop loss and take profit levels.

By pairing the CCI Double EMA Indicator with other tools such as trend lines, Fibonacci retracements, or moving averages, traders can gain additional insights into market behavior.

Trading strategies with the CCI Double EMA Indicator can be enhanced by incorporating other indicators such as Relative Strength Index (RSI) or Stochastic Oscillator.

These indicators can confirm signals generated by the CCI Double EMA Indicator or provide alternative signals when there is ambiguity in the data.

Additionally, using multiple timeframes for analysis can help to identify long-term trends as well as short-term fluctuations.

Overall, integrating various technical analysis tools with the CCI Double EMA Indicator can lead to better trading decisions and improved profitability for traders.

Common Mistakes to Avoid When Trading with the CCI Double EMA Indicator

To effectively utilize the CCI Double EMA Indicator in trading, it is essential to avoid common mistakes that can lead to inaccurate interpretations of market trends and potentially result in financial losses. One misconception about this indicator is that it should be used on any timeframe. However, the best timeframes to use depend on the trader’s preferences and goals. Generally, shorter timeframes such as 5-minute or 15-minute charts suit traders who prefer scalping while longer timeframes like 1-hour or 4-hour charts work better for swing traders.

Another common mistake when using this indicator is relying solely on its signals without considering other technical analysis tools. Traders should always use the CCI Double EMA Indicator in conjunction with other indicators such as support and resistance levels, moving averages, and trendlines to confirm their trade decisions. By doing so, they increase their chances of making profitable trades by filtering out false signals generated by the indicator alone. The table below summarizes some of the common mistakes traders make when using the CCI Double EMA Indicator along with tips on how to avoid them.

| Common Mistakes | How to Avoid Them | |||

|---|---|---|---|---|

| Using any timeframe | Choose a timeframe based on your style (scalping vs swing trading) | |||

| Relying solely on CCI signals | Use additional technical analysis tools for confirmation | |||

| Not adjusting settings | Adjust settings based on market volatility | |||

| Ignoring overbought/oversold conditions | Wait for price action confirmation before entering trades | |||

| Trading against the trend | Always trade in line with prevailing market trends | Failing to have a clear trading plan and sticking to it | Develop a comprehensive trading plan and follow it strictly to avoid making impulsive and emotional decisions. |

Conclusion

In conclusion, the CCI Double EMA Indicator for MT4 can be a valuable tool for traders looking to identify trends and potential entry and exit points. By combining two popular indicators, it offers a unique perspective on market movements.

However, as with any indicator or trading strategy, it is important to use proper risk management techniques and not solely rely on the indicator for decision making.

To maximize your success with the CCI Double EMA Indicator, consider using it in conjunction with other analysis tools and incorporating fundamental analysis into your trading decisions. It is also essential to have a solid understanding of technical analysis concepts such as support and resistance levels, chart patterns, and trend lines.

By continuously learning and refining your trading approach, you can potentially increase your profitability while minimizing risk.