Candlesticks Signals Mt4 Indicator Review

Candlestick charts have become a staple in technical analysis due to their ability to convey valuable information about market sentiment and price action. The Candlesticks Signals MT4 Indicator is a tool designed specifically for MetaTrader 4 (MT4) that helps traders identify potential trading opportunities based on candlestick patterns.

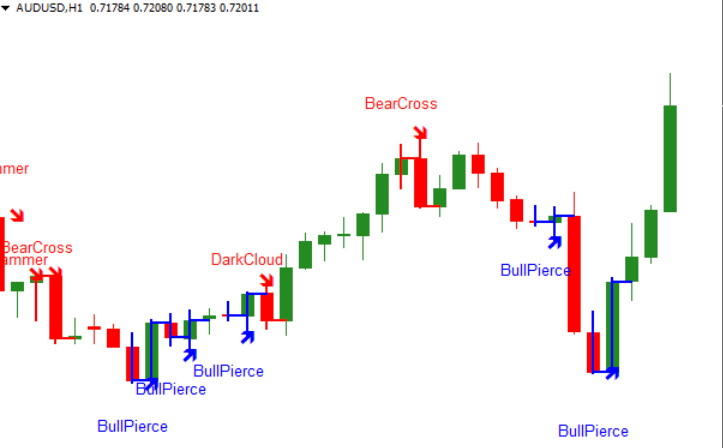

This indicator works by scanning the chart for specific candlestick patterns, such as dojis, hammers, engulfing patterns, and more. When a pattern is identified, the indicator signals it with an alert or visual cue on the chart.

Download Free Candlesticks Signals Mt4 Indicator

This allows traders to quickly identify potential buying or selling opportunities and make informed decisions based on the current market conditions. In this article, we will explore how to use the Candlesticks Signals MT4 Indicator and discuss its benefits for traders of all levels.

What is the Candlesticks Signals MT4 Indicator?

The section explores a tool that provides users with visual representations of price movements in financial markets, using the patterns and shapes formed by candlesticks.

The Candlesticks Signals MT4 Indicator is a technical analysis tool designed to help traders identify potential price trends and reversals on charts within the MetaTrader 4 platform. The indicator features various candlestick analysis techniques that generate signals based on different patterns formed by candlestick charting.

Candlestick charting is a popular method used by traders to analyze market trends. It involves plotting prices over time using candle-shaped bars, each representing an interval of time (such as one minute or one day). The shape of each candle reflects the opening, closing, high, and low prices for that period.

By identifying patterns in these candles, traders can gain insights into market sentiment and potential future price movements. The Candlesticks Signals MT4 Indicator uses these patterns to generate buy or sell signals based on specific criteria established within the indicator settings.

How to Use the Candlesticks Signals MT4 Indicator

Setting up the Candlesticks Signals MT4 Indicator requires downloading and saving the .ex4 file into the ‘Indicators’ folder of your MT4 platform.

Once imported, you can drag and drop the indicator onto your chart to view signals in real-time.

Identifying candlestick patterns with this indicator involves paying attention to color changes and alert notifications for bullish or bearish signals, such as engulfing candles or harami patterns.

Incorporating this indicator into your trading strategy allows you to make informed decisions based on market trends and signal confirmations, maximizing profit potential while minimizing risk.

Setting up the indicator in MT4

To configure the Candlesticks Signals MT4 Indicator, users must customize the settings to display relevant data. To do this, users can access the settings menu within the MT4 platform and input their desired parameters, such as signal types, colors, and alerts.

Users can also adjust the indicator’s sensitivity by selecting a timeframe or changing the number of periods used in calculations. Customizing settings is essential for tailoring the indicator to meet individual trading needs.

However, if users encounter issues with setting up or troubleshooting problems with the Candlesticks Signals MT4 Indicator, they can seek assistance from technical support teams or online forums dedicated to trading indicators. It is crucial to ensure that all customization options are correctly set up before using any trading software to avoid errors in interpreting signals and making decisions based on incorrect data.

Identifying candlestick patterns

Identifying patterns in price movements through the use of visual representations such as candlesticks is crucial for effective technical analysis in financial trading.

Candlestick analysis techniques are based on the premise that market psychology and sentiment can be revealed through the shape and color of candlesticks. By understanding these patterns, traders can make more informed decisions about when to enter or exit a trade.

Trading psychology plays an important role in identifying candlestick patterns. Patterns such as Doji, Hammer, Shooting Star, and other bullish or bearish reversal signals indicate changes in market sentiment. Traders who understand how these signals work are better equipped to anticipate trend reversals and take advantage of potential profit opportunities.

In conclusion, mastering candlestick analysis techniques is essential for any trader looking to improve their technical analysis skills and gain an edge in the markets.

Incorporating the indicator into your trading strategy

Integrating technical indicators into trading strategies can enhance a trader’s ability to make informed decisions by providing additional insights into market trends and price movements. One such indicator is the candlesticks signals MT4 indicator, which identifies important candlestick patterns that can provide valuable information about potential market reversals or continuations.

However, simply incorporating this indicator into your trading strategy may not be enough to guarantee success. It is important to understand its limitations and how it can be combined with other indicators for optimal results.

Before incorporating the candlesticks signals MT4 indicator into your live trading strategy, it is recommended to backtest its effectiveness using historical data. This will help you determine if the indicator provides reliable signals in various market conditions and timeframes. Additionally, backtesting allows you to optimize the settings of the indicator for better performance.

The candlesticks signals MT4 indicator should not be used in isolation as it only provides limited information about price movements. Traders should consider combining it with other technical indicators that provide complementary insights such as trend direction, momentum, and support/resistance levels. By combining multiple indicators, traders can get a more comprehensive view of market conditions and make well-informed trading decisions based on multiple sources of information.

Finally, traders must keep an eye on important news events that could affect their trades even when using technical indicators like the candlesticks signals MT4 indicator. Unexpected news releases could cause sudden price movements that may override any technical signal provided by an indicator. Therefore, traders should always stay up-to-date on economic announcements and be prepared to adjust their positions accordingly.

Benefits of Using the Candlesticks Signals MT4 Indicator

The benefits of using the Candlesticks Signals MT4 Indicator are numerous and may provide traders with a valuable edge in their decision-making processes.

Firstly, the indicator offers a visual representation of price action that can help traders better understand market trends and patterns. This information can be used to identify potential entry and exit points, as well as to set stop-loss levels.

Additionally, the indicator provides users with real-time alerts when specific candlestick patterns occur, allowing them to act quickly on trading opportunities.

Another benefit of using this technical analysis tool is that it can assist with backtesting results. Traders can use historical data to test different strategies and see how they would have performed in real-world scenarios. By incorporating the Candlesticks Signals MT4 Indicator into their backtesting process, traders can gain insights into how particular candlestick patterns behave under different market conditions.

Finally, there are also trading psychology implications when using this indicator. It allows traders to remain objective while making trading decisions by removing the emotional element from their analysis. By relying on data-driven insights provided by the indicator, traders may be able to avoid irrational or impulsive trades that could negatively impact their overall performance.

Conclusion

The Candlesticks Signals MT4 Indicator is a useful tool for traders looking to identify potential market trends. By analyzing candlestick patterns, the indicator can provide valuable insights into market sentiment and help traders make informed decisions about when to enter or exit trades.

To use the indicator effectively, traders should familiarize themselves with common candlestick patterns and understand how they relate to price movements. Overall, the Candlesticks Signals MT4 Indicator is a powerful tool that can give traders an edge in the market.

By providing clear visual signals of potential trend reversals or continuations, the indicator can help traders make more accurate predictions about market movements. With its user-friendly interface and customizable settings, it is a valuable addition to any trader’s toolkit.

However, as with any trading strategy or tool, it is important to use the indicator in conjunction with other forms of analysis and exercise caution when making trading decisions.