Candlestick Pattern Recognition Master For Mt4 Review

Candlestick charts are a popular tool used by traders to understand the price movement of assets in financial markets. These charts display the open, high, low, and close prices for a given time period using candlestick shapes that provide valuable information about market trends and patterns.

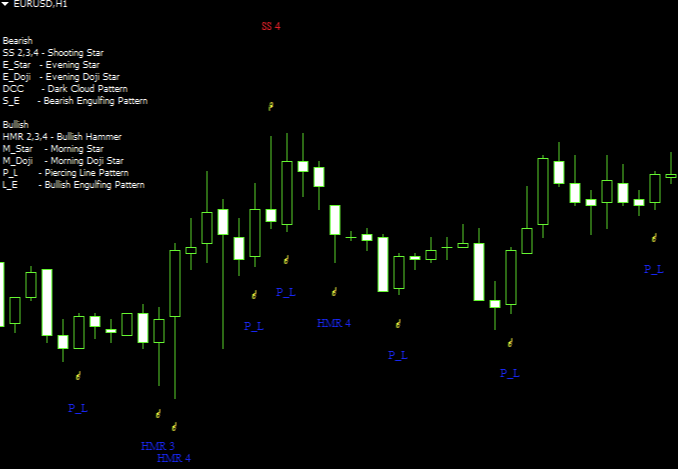

However, analyzing these charts manually can be tedious and time-consuming, which is where Candlestick Pattern Recognition Master for MT4 comes in. Candlestick Pattern Recognition Master for MT4 is an advanced trading software designed to automate the process of identifying candlestick patterns on charts.

Download Free Candlestick Pattern Recognition Master For Mt4

With its powerful algorithms and real-time scanning capabilities, this software allows traders to quickly identify bullish or bearish signals based on complex candlestick formations. In this article, we will explore the benefits of using Candlestick Pattern Recognition Master for MT4 and how it can improve your trading performance.

Understanding Candlestick Charts in Trading

The comprehension of candlestick charts is a crucial aspect in trading as it enables traders to analyze the behavior of market trends and identify potential entry and exit points.

Candlestick charts were first developed in Japan during the 18th century by rice traders who used them to track the price fluctuations of their commodity. The technique then spread to other parts of the world, particularly the United States, where it was popularized by Steve Nison in his book ‘Japanese Candlestick Charting Techniques.’

Candlestick charts display information about an asset’s price movement over a certain period. They consist of two main components: the body and wick/shadow. The body represents the opening and closing prices during that period, while the wicks represent the highest and lowest prices reached within that same timeframe.

Understanding common candlestick patterns can help traders make informed decisions about when to buy or sell an asset. Some common patterns include doji, hammer, engulfing, and morning/evening star patterns. By analyzing these patterns, traders can predict market behavior with greater accuracy and take advantage of profitable opportunities.

Benefits of Using Candlestick Pattern Recognition Master for MT4

Utilizing a software tool that automatically identifies potential market trends can provide traders with a competitive advantage and improve their decision-making process.

One such tool is the Candlestick Pattern Recognition Master for MT4, which identifies candlestick patterns in real-time and alerts traders of potential buy or sell signals. This powerful tool saves traders time by eliminating the need to manually scan charts for patterns, enabling them to focus on developing trading strategies.

Moreover, the use of Candlestick Pattern Recognition Master for MT4 can lead to improved accuracy in identifying profitable trades. By utilizing advanced algorithms, this software provides traders with reliable pattern recognition capabilities that are not influenced by human biases or emotions.

Furthermore, it allows traders to backtest their trading strategies using historical data, providing them with valuable insights into the effectiveness of their approach. Overall, incorporating Candlestick Pattern Recognition Master for MT4 into one’s trading strategy can help achieve consistent profits while minimizing risks associated with manual analysis of market trends.

How to Use Candlestick Pattern Recognition Master for MT4

Candlestick Pattern Recognition Master for MT4 is a powerful tool that can help traders identify profitable trading opportunities.

The installation and setup process is straightforward and easy to follow, allowing users to quickly begin analyzing patterns and making informed trading decisions.

By accurately identifying candlestick patterns and analyzing them with precision, traders can increase their chances of success in the market.

Installation and Setup

This section outlines the steps required to successfully install and set up Candlestick Pattern Recognition Master for MT4. The software is designed to identify specific visual cues on price charts within a popular trading platform, making it an essential tool for traders seeking to improve their decision-making process.

Follow these three simple steps to get started:

- Download the necessary files from a reputable source and save them in a location where they can be easily accessed.

- Open the trading platform and navigate to the ‘File’ tab, then select ‘Open Data Folder.’

- Copy and paste the downloaded files into the ‘MQL4’ folder, then restart the MT4 platform.

Once installation is complete, configuring settings may be necessary depending on your preferences and trading strategy. Troubleshooting installation issues can also be addressed by referring to user guides or seeking assistance from support teams provided by developers of this software program.

Identifying Candlestick Patterns

The identification of visual cues on price charts is a critical aspect of successful trading, and this section provides guidance on how to identify candlestick patterns within the MT4 platform. Candlestick pattern identification techniques involve analyzing the shape and color of individual candles or groups of candles to determine potential market trends. Common candlestick patterns in forex trading include Doji, Hammer, Shooting Star, Engulfing Pattern, and Morning/Evening Star.

To assist traders in identifying these patterns accurately and efficiently, the following table outlines the key characteristics of each pattern:

| Candlestick Pattern | Description |

|---|---|

| Doji | A small-bodied candle with wicks at both ends that indicates indecision between buyers and sellers. |

| Hammer | A bullish reversal pattern characterized by a long lower wick and small body formed after a downtrend. |

| Shooting Star | A bearish reversal pattern characterized by a long upper wick and small body formed after an uptrend. |

| Engulfing Pattern | A reversal pattern where one candle completely engulfs the previous one’s body. Bullish engulfing patterns form at the end of downtrends while bearish engulfing patterns form at the end of uptrends. |

| Morning/Evening Star | Consists of three candles: a large-bodied one followed by a smaller-bodied one that gaps opposite to the trend direction; then another large-bodied one that closes beyond half way into the first candle. |

By using these candlestick pattern identification techniques along with other technical analysis tools such as support and resistance levels or moving averages, traders can develop more accurate predictions about future price movements in forex markets. It is important to note, however, that no strategy can guarantee success in trading as various factors such as economic events or news releases can cause sudden shifts in market sentiment leading to unexpected outcomes. Therefore, it is crucial for traders always to manage their risk properly through proper position sizing and stop-loss placement.

Analyzing Patterns and Making Informed Trading Decisions

In order to make informed trading decisions, it is important for traders to analyze candlestick patterns alongside other technical analysis tools and risk management strategies to develop a comprehensive approach to forex trading.

Analyzing market trends and interpreting price movements can help traders identify potential opportunities and risks in the market. Candlestick patterns provide valuable information about the psychology of buyers and sellers, indicating whether the market is bullish or bearish.

Traders can use various technical indicators such as moving averages, RSI, MACD, and Fibonacci retracements to confirm their analysis of candlestick patterns. Combining these indicators with candlestick patterns can help traders identify support and resistance levels, trend reversal points, entry and exit points for trades, and stop loss levels.

However, it is important for traders not to rely solely on candlestick patterns or technical indicators but also incorporate fundamental analysis in their decision-making process. By adopting a holistic approach that considers both technicals and fundamentals alongside proper risk management strategies, traders can increase their chances of success in forex trading.

Improving Your Trading Performance with Candlestick Pattern Recognition Master for MT4

Enhancing one’s trading proficiency and optimizing returns can be achieved by leveraging the insights provided by candlestick chart analysis and its accompanying indicators. With Candlestick Pattern Recognition Master for MT4, traders can identify patterns in real-time with high accuracy levels, enabling them to make informed trading decisions.

The following strategies can help improve your trading performance with this tool:

- Identify trend reversals: Use the tool to recognize reversal patterns like bullish engulfing or bearish harami, indicating a possible change in trend direction.

- Confirming entry and exit signals: Combine candlestick pattern recognition master with other technical indicators like moving averages or RSI to confirm entry and exit signals.

- Avoid emotional bias: Backtesting results with candlestick pattern recognition master for MT4 can help traders avoid making emotional decisions based on market fluctuations.

- Risk management: Utilize stop-loss orders placed below identified support levels from the pattern analysis strategy to limit losses.

- Enhance profitability: Recognizing profitable patterns such as morning stars or evening stars through backtesting results can enable traders to optimize their profits.

By incorporating these strategies into their daily routine, traders using Candlestick Pattern Recognition Master for MT4 can enhance their trading proficiency and optimize returns while minimizing risk exposure.

Conclusion

In conclusion, understanding candlestick charts is essential for traders to make informed decisions in the financial market. Candlestick Pattern Recognition Master for MT4 provides many benefits such as identifying trends and providing insights on when to enter or exit a trade.

By using this tool, traders can improve their trading performance by making well-informed trades based on pattern recognition.

To use Candlestick Pattern Recognition Master for MT4 effectively, traders should learn how to interpret candlestick patterns and understand the different types of patterns that exist. With practice and patience, traders can gain confidence in their trading abilities and become successful in the financial market.

Overall, Candlestick Pattern Recognition Master for MT4 is an excellent tool that can assist traders in making profitable trades while minimizing risks.