Camarilla Lines Blue Indicator For Mt4 Review

The Camarilla Equation is a popular trading strategy used by traders to identify potential support and resistance levels in the market. It was developed by Nick Scott, a trader who believed that the market has a tendency to revert back to its mean price level after experiencing significant movements.

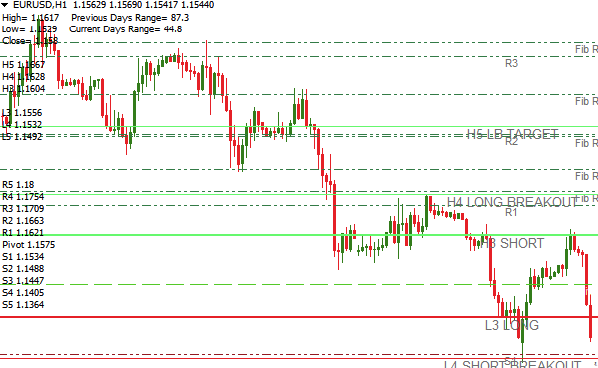

The equation uses mathematical calculations based on the previous day’s high, low, and close prices to determine eight levels of support and resistance. One way to implement the Camarilla Equation is through the use of indicators such as the Camarilla Lines Blue Indicator for MT4.

Download Free Camarilla Lines Blue Indicator For Mt4

This indicator plots the eight levels of support and resistance on a chart, making it easier for traders to identify potential entry and exit points. In this article, we will explore how to use this indicator effectively and discuss its benefits for traders looking to incorporate the Camarilla Equation into their trading strategies.

What is the Camarilla Equation?

The Camarilla Equation is a mathematical formula used in financial analysis to determine potential support and resistance levels for trading securities. It was first introduced by Nick Stott, a trader who believed that price movements in the market tend to revert back to the mean, and it can be used to identify key levels for traders to enter or exit positions.

The Camarilla equation calculation involves taking the previous day’s high, low, and close prices and using them in a series of complex calculations. The result is eight different levels which are labeled as L1-L4 (support levels) and H1-H4 (resistance levels).

Traders who use the Camarilla trading strategy implementation rely on these eight levels as potential entry or exit points for their trades. When the price reaches one of these levels, traders will look for signals indicating whether they should buy or sell based on other technical indicators such as moving averages or oscillators.

Traders can also use these levels to set stop-loss orders at predetermined points below support or above resistance levels. Overall, the Camarilla Equation has become a popular tool among technical analysts due to its ability to identify potential turning points in the market with high accuracy.

How to Use the Camarilla Lines Blue Indicator for MT4

This section outlines the steps for effectively utilizing the Camarilla Lines Blue Indicator within the widely used MetaTrader 4 platform. This technical analysis tool is primarily used to identify potential support and resistance levels in trading markets. Compared to other support and resistance indicators, such as pivot points or Fibonacci retracements, the Camarilla Equation offers a more complex formula that incorporates multiple levels of price action.

To use the Camarilla Lines Blue Indicator in MT4, follow these steps:

- Install the indicator onto your MT4 platform by downloading it from a reliable source and placing it into your ‘Indicators’ folder.

- Open up your desired chart and select ‘Camarilla Lines Blue’ from your list of indicators.

- Once applied, you will see six lines on your chart – three resistance levels (R1-R3) and three support levels (S1-S3).

- These levels can be used to identify potential areas of buying or selling pressure.

- Traders can use these levels in conjunction with other technical analysis tools to make informed trading decisions.

Overall, utilizing the application of camarilla lines blue indicator can provide valuable insights into market trends and potential price movements. It is important to note that no single technical analysis tool should be relied upon entirely, but rather should be used in combination with other methods for a well-rounded trading strategy.

Benefits of Using the Camarilla Lines Blue Indicator for MT4

Improved accuracy in identifying support and resistance levels, potential for better trading decisions and profitability, and a time-saving tool for traders are among the benefits of using the Camarilla Lines Blue Indicator for MT4.

This indicator helps traders to identify key price levels that can be used as entry or exit points to maximize profits while minimizing losses. Additionally, it saves traders time by automatically plotting these levels on charts, allowing them to focus on making informed trading decisions.

Improved accuracy in identifying support and resistance levels

Accurately identifying support and resistance levels can greatly enhance a trader’s ability to make informed decisions when entering or exiting positions in the market. Technical analysis strategies are widely used by traders to anticipate future price movements based on past market data. Among these strategies is the use of support and resistance levels, which refer to price points where buying or selling pressure is expected to be strong enough to reverse the direction of an asset’s price movement.

Forex trading tools like the Camarilla Lines Blue Indicator for MT4 can help traders identify potential support and resistance levels with improved accuracy. This indicator draws horizontal lines on a chart that represent key price levels derived from a mathematical formula based on yesterday’s high, low, and close prices. These lines can serve as reference points for traders looking to enter or exit trades at optimal price levels.

By incorporating this tool into their technical analysis strategy, traders may be able to better predict potential reversals in an asset’s price movement, leading to more profitable trading decisions.

Potential for better trading decisions and profitability

The incorporation of technical analysis tools such as support and resistance levels into a trader’s strategy may lead to more informed trading decisions and potentially greater profitability in the forex market.

The Camarilla Lines Blue Indicator for MT4 offers a unique approach to identifying these key levels with improved accuracy, allowing traders to make better-informed decisions about when to enter or exit trades.

By using this indicator in combination with other technical analysis tools, traders can gain a deeper understanding of market trends and potential price movements.

However, it is important to note that successful trading goes beyond just technical analysis.

Trading psychology plays a significant role in making profitable trades, as emotional biases can cloud judgment and lead to poor decision-making.

Additionally, risk management strategies must be implemented to protect against potential losses.

When used responsibly and in conjunction with other analytical methods, the Camarilla Lines Blue Indicator for MT4 has the potential to improve trading outcomes and increase profitability for forex traders.

Time-saving tool for traders

Using an efficient tool that streamlines the trading process can save time for traders, allowing them to focus on other important aspects of their strategy and potentially increase their productivity. The Camarilla Lines Blue Indicator for MT4 is a perfect example of such a tool. With its advanced customization options, traders can set up automated trades based on specific market conditions and strategies without having to manually execute each trade.

Moreover, the Camarilla Lines Blue Indicator for MT4 provides traders with real-time data analysis, eliminating the need for manual calculation and analysis. This allows traders to make faster decisions based on accurate data, which can lead to better trading outcomes and increased profitability. To illustrate this point further, consider the following table:

| Without Camarilla Lines Blue Indicator | With Camarilla Lines Blue Indicator |

|---|---|

| Manually calculating support and resistance levels takes time away from analyzing market trends | Real-time analysis of support and resistance levels frees up time for trend analysis |

| Manual execution of trades can lead to missed opportunities or delayed responses to market changes | Automated trading based on customizable parameters allows for quick responses to changing market conditions |

Overall, incorporating tools like the Camarilla Lines Blue Indicator into one’s trading strategy not only saves valuable time but also has the potential to improve decision-making processes and ultimately increase profitability.

Conclusion

The Camarilla Equation is a popular technical analysis tool used by traders to identify potential price levels for a specific trading day. The equation calculates eight levels of support and resistance based on the previous day’s high, low, and close prices.

The Camarilla Lines Blue Indicator for MT4 simplifies this process by automatically plotting these levels on a chart. Using the Camarilla Lines Blue Indicator can provide traders with clear entry and exit points, as well as help them manage risk by identifying potential stop-loss positions.

Additionally, the indicator can be customized to fit individual trading strategies and preferences. Overall, incorporating the Camarilla Lines Blue Indicator into one’s trading strategy can assist in making informed decisions and potentially increasing profitability.