Bollinger Squeeze Vstochastic Indicator For Mt4 Review

Technical analysis is a popular method used by traders to identify potential trading opportunities in financial markets. Various indicators are utilized to analyze market trends, price movements, and volatility levels.

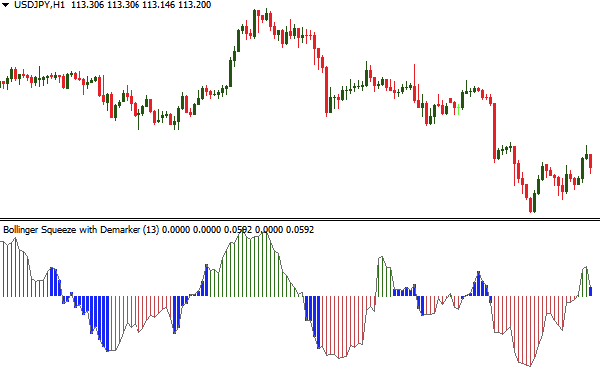

Two commonly used indicators are the Bollinger Squeeze and Stochastic Indicators. The Bollinger Squeeze Indicator measures volatility while the Stochastic Indicator identifies overbought or oversold market conditions.

The Bollinger Squeeze Indicator is based on the concept of Bollinger Bands, which are plotted two standard deviations away from a moving average line. When the bands narrow, indicating reduced volatility, this is known as a squeeze. Traders use this information to anticipate an impending breakout in either direction when prices eventually break out of the narrowed range. On the other hand, if the bands widen significantly, it suggests increased volatility and potentially large price movements in either direction.

Download Free Bollinger Squeeze Vstochastic Indicator For Mt4

The Stochastic Indicator measures momentum by comparing closing prices with a range of high-low values over a specified period. It provides information about where prices are relative to their recent trading range and can signal potential trend reversals or continuations when crossing certain thresholds.

Understanding the Bollinger Squeeze Indicator

The current section provides an in-depth understanding of a technical analysis tool that utilizes the concept of volatility and band widths to identify potential breakouts in the market.

The Bollinger Squeeze indicator is a popular tool among traders as it helps them identify periods where there is low volatility in the market, which often precedes explosive moves. This indicator comprises two bands – an upper band and a lower band – which are plotted at a fixed distance from a moving average.

When the price starts to consolidate within these bands, it indicates that there is low volatility or decreasing price movements. One common misconception about this indicator is that it predicts future prices; however, its primary function is to measure volatility rather than predict prices.

The Bollinger Squeeze indicator can be used in conjunction with other technical indicators such as momentum oscillators or volume indicators for better trading signals. Additionally, traders should analyze historical performance before relying solely on this tool for entry and exit decisions as past performance does not guarantee future results.

Understanding the Stochastic Indicator

One of the most widely used momentum oscillators in technical analysis, the Stochastic Indicator helps traders identify potential trend reversals by measuring the momentum of price movements. Developed by George Lane in the 1950s, this indicator compares a security’s closing price to its price range over a specific period.

The Stochastic Oscillator consists of two lines: %K and %D. The %K line represents the current closing price relative to the high and low prices over a specified time frame (usually 14 periods), while %D is a smoothed version of %K.

The Stochastic Indicator is commonly used to identify overbought and oversold levels in a security. When the indicator rises above 80, it is considered overbought, indicating that prices may be due for a pullback or reversal. Conversely, when it falls below 20, it is considered oversold, suggesting that prices may rise soon.

Traders often use these levels as signals to enter or exit trades. However, it is important to note that some securities can remain in an overbought or oversold condition for extended periods without reversing course, so traders must exercise caution when interpreting these signals and consider other factors such as market trends and news events before making trading decisions based on stochastic oscillator readings.

Combining the Bollinger Squeeze and Stochastic Indicators

Using the Bollinger Squeeze Vstochastic Indicator for MT4 can provide traders with valuable information to make informed trading decisions. Combining these two indicators can help identify potential entry and exit points in the market.

To utilize this strategy effectively, it is important to follow best practices such as using proper risk management techniques and backtesting your approach.

Using the Bollinger Squeeze Vstochastic Indicator for MT4

This section presents a comprehensive guide on how to effectively utilize the Bollinger Squeeze Vstochastic Indicator for MT4 in forex trading. This analytical tool is a combination of two distinct indicators, namely the Bollinger Bands and Stochastic Oscillator. The Bollinger Bands are used to indicate volatility levels, while the Stochastic Oscillator measures momentum. Combining these two indicators can provide traders with valuable insights into market trends and potential trading opportunities.

To use the Bollinger Squeeze Vstochastic Indicator for MT4 effectively, traders should follow these steps:

- Set up the indicator in MT4 by selecting it from the navigator window.

- Use other oscillators such as RSI or MACD to confirm signals generated by this indicator.

- Backtest results using historical data to ensure that the strategy is profitable over time.

- Adjust settings based on personal preferences and market conditions.

By following these steps and analyzing backtesting results, traders can gain confidence in their trading strategies and potentially increase their profits in forex trading.

Trading Strategies and Best Practices

To effectively navigate the volatile and constantly changing forex market, it is crucial for traders to develop sound trading strategies and adhere to best practices that prioritize risk management, disciplined decision-making, and continuous learning. With the Bollinger Squeeze Vstochastic Indicator for MT4, traders can use a variety of trading strategies that incorporate both indicators to identify potential trade opportunities in any market condition.

One such strategy involves using the Bollinger Bands as a guide for entry and exit points while relying on the Stochastic Oscillator to confirm momentum. Traders can also use backtesting techniques to evaluate how effective their strategies are over time and adjust accordingly. Other best practices include setting stop-loss orders at strategic levels based on support and resistance levels, diversifying portfolios across multiple currency pairs, and maintaining emotional discipline by avoiding impulsive trades or excessive risk-taking. By incorporating these strategies and adhering to best practices, traders can effectively use the Bollinger Squeeze Vstochastic Indicator for MT4 to make informed trading decisions with greater confidence.

| Pros | Cons | ||

|---|---|---|---|

| Can help identify potential trade opportunities in any market condition | May generate false signals during choppy markets | ||

| Offers clear entry/exit points based on Bollinger Bands | Requires knowledge of technical analysis principles | ||

| Confirms momentum with Stochastic Oscillator | Should be used in conjunction with other indicators or analysis | ||

| Can be used with backtesting techniques for evaluation over time | Cannot guarantee profitable trades without proper risk management measures | Technical analysis principles are based on historical price and volume data, and may not necessarily predict future market movements with absolute certainty. |

Conclusion

The Bollinger Squeeze and Stochastic Indicators are two popular technical analysis tools used by traders to identify potential entry and exit points.

The Bollinger Squeeze Indicator is based on the concept of volatility contraction, where the upper and lower Bollinger Bands converge towards each other, indicating a period of low volatility which is likely to be followed by a period of high volatility.

On the other hand, the Stochastic Indicator measures momentum in a price trend by comparing the current closing price to its range over a specific period.

Combining these two indicators can provide traders with a more comprehensive understanding of market trends and potential trade opportunities.

By identifying periods of low volatility using the Bollinger Squeeze Indicator and then using the Stochastic Indicator to confirm momentum in one direction or another, traders can enter trades with greater confidence.

However, it is important to note that no indicator or combination of indicators can guarantee success in trading, as market conditions are always subject to change.

Thus, it is crucial for traders to continuously monitor their positions and adapt their strategies accordingly.