Bollinger Bands Macd Cct Indicator Mt4 Review

The Bollinger Bands Macd Cct Indicator MT4 is a popular technical analysis tool used by traders to identify potential buy and sell signals in the financial markets. This indicator combines two well-known indicators, the Bollinger Bands and the Moving Average Convergence Divergence (MACD) indicator, with an additional custom-made Center of Gravity (CCT) line to provide traders with a comprehensive trading tool.

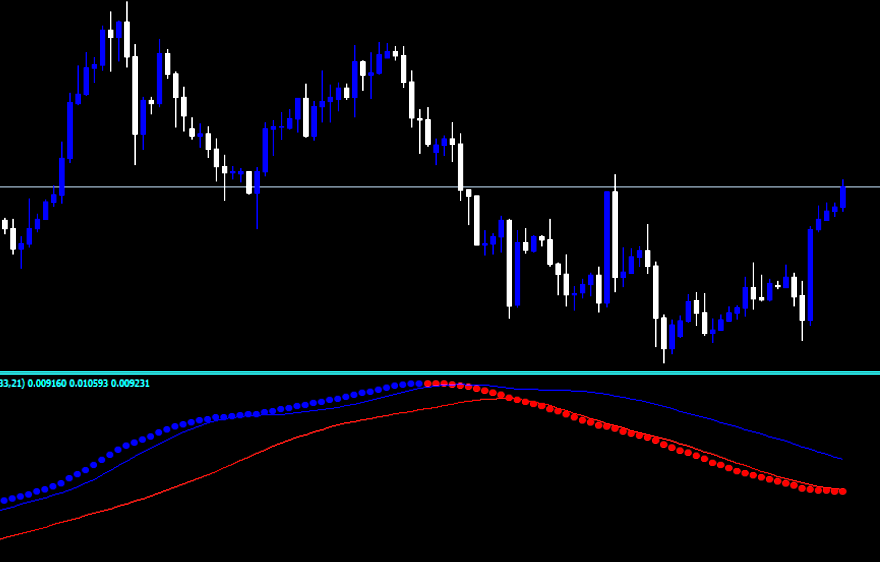

The Bollinger Bands Macd Cct Indicator MT4 works by plotting three lines on a price chart. The upper and lower bands are calculated based on the standard deviation of price movements over a specific period, while the centerline is derived from the CCT line.

Download Free Bollinger Bands Macd Cct Indicator Mt4

The MACD component of this indicator measures the relationship between two moving averages to determine trend direction and strength. By combining these elements, traders can make informed decisions about when to enter or exit trades based on current market conditions.

In this article, we will explore how this powerful indicator works and how it can be applied in trading strategies for improved performance.

Understanding the Bollinger Bands Macd Cct Indicator MT4

The current section aims to provide an understanding of a technical analysis tool that utilizes volatility and moving averages to identify potential buying and selling opportunities in financial markets.

The Bollinger Bands Macd Cct Indicator MT4 combines two popular indicators: the Bollinger Bands and the Moving Average Convergence Divergence (MACD). The Bollinger Bands measure price volatility by calculating the standard deviation of price movements over a certain period, while the MACD measures trend strength and momentum through the difference between two exponential moving averages.

Using the Bollinger Bands Macd Cct Indicator MT4 for technical analysis involves interpreting signals from both indicators. When using these indicators together, traders can look for situations where prices are trading near or outside of the upper or lower bands while also showing bullish or bearish MACD crossovers.

This combination suggests that there may be significant changes in market sentiment, which could lead to potential buying or selling opportunities. Additionally, traders could also use this indicator to confirm trends seen on other charts or with other technical tools. By utilizing this technical analysis tool, traders can gain insights into market trends and make informed decisions regarding their trades.

Applying the Bollinger Bands Macd Cct Indicator MT4 in Trading Strategies

Applying the Bollinger Bands Macd Cct Indicator MT4 can be utilized in various trading strategies such as trend following, momentum trading, and range trading.

In a trend following strategy, the indicator helps traders identify the direction of trend movements by analyzing the upper and lower bands alongside moving averages.

Momentum trading strategies utilize the Bollinger Bands Macd Cct Indicator MT4 to identify potential buy or sell signals based on changes in momentum or acceleration of price movements.

Trend Following Strategy

A trend following strategy can be utilized in trading by identifying the direction of a market trend and initiating positions in the same direction to capitalize on potential gains. In this approach, traders believe that markets tend to move in trends over time and that these trends can continue for extended periods.

To implement this strategy, traders use technical indicators such as moving averages or Bollinger Bands to identify the direction of a trend. They then initiate trades in the same direction as the identified trend.

Using backtesting to evaluate the effectiveness of trend following strategies is crucial for traders. Backtesting involves testing a trading strategy on historical data to see how it would have performed if implemented earlier. By using backtesting, traders can assess how effective their chosen indicators are at identifying trends and generating profitable trades.

Additionally, combining Bollinger Bands Macd Cct Indicator with other technical indicators like Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) can improve trading signals by confirming a trend’s strength or indicating when it’s about to change direction.

Traders should always consider risk management principles when implementing any strategy and adjust their position sizes accordingly based on their individual risk tolerance levels and objectives.

Momentum Trading Strategy

One popular trading strategy is momentum trading, which involves identifying stocks or other securities that are experiencing significant price movement in a particular direction and initiating trades to capitalize on the trend.

This strategy is based on the idea that securities that have been rising or falling rapidly will continue to do so in the near future. Momentum traders use technical indicators such as moving averages, Relative Strength Index (RSI), and MACD to identify trends and potential entry and exit points.

Momentum trading psychology plays a crucial role in this strategy’s success. Traders must be able to manage their emotions effectively, remain disciplined, and execute trades quickly and decisively.

Backtesting the strategy can also help traders determine if it is effective for their specific circumstances by analyzing historical data using various parameters. It allows traders to fine-tune their approach, test different scenarios, and evaluate the strength of their signals before entering live markets.

Overall, momentum trading can be a powerful tool for experienced traders who are comfortable with risk management strategies but may not be suitable for beginners or those looking for long-term investments.

Range Trading Strategy

Range trading strategy is another popular approach in which traders identify support and resistance levels to trade within a relatively stable price range.

This strategy involves buying at the support level and selling at the resistance level, with profits being made from the price movements within this range.

Range trading is considered a safer approach compared to other high-risk strategies as it minimizes the potential losses by keeping trades within a certain boundary.

Trading psychology plays an important role in executing range trading strategy effectively.

Traders must have discipline, patience, and emotional control when trading within a narrow range.

They should also be able to accurately identify these levels using technical analysis tools such as Bollinger Bands, MACD, and CCT indicators on MT4 platform.

Risk management is also crucial in controlling losses during unexpected market volatility that could cause prices to break outside of the identified range.

Tips for Improving Your Trading Performance with the Bollinger Bands Macd Cct Indicator MT4

Enhancing trading proficiency can be achieved by adopting effective strategies when utilizing the Bollinger Bands Macd Cct Indicator in MT4.

One way to improve your performance with this indicator is to backtest its results. This will allow you to see how well it has performed historically and help you identify patterns that could influence your future trades.

By analyzing past data, you can refine your strategy and better understand how the indicator behaves in various market conditions. Another tip for improving your trading performance with the Bollinger Bands Macd Cct Indicator MT4 is customizing its settings.

While the default settings may work for some traders, adjusting them to suit your specific needs and preferences can enhance its accuracy and effectiveness. For example, changing the period length or deviation levels can help you fine-tune your approach and adapt to different market environments.

Additionally, experimenting with different timeframes or combinations of indicators can provide valuable insights into optimal usage of this tool. Overall, taking a proactive approach to customizing and testing this indicator can lead to more informed decisions and ultimately improve your trading outcomes.

Conclusion

In conclusion, the Bollinger Bands Macd Cct Indicator MT4 is a powerful technical analysis tool that can aid traders in making informed trading decisions. By combining the volatility measurement of Bollinger Bands with the trend-following ability of MACD and the momentum indicator CCT, traders can potentially identify profitable entry and exit points in their trades.

However, it is important to note that no trading strategy or indicator is foolproof and traders should always practice risk management techniques to minimize potential losses.

To further improve your trading performance with this indicator, it is recommended to backtest your strategies and analyze historical data to identify patterns and trends. Additionally, keeping a trading journal and regularly reviewing your trades can help you refine your approach and make more informed decisions in the future.

With proper use and understanding of this indicator, traders may have a valuable tool at their disposal for successful trading outcomes.