Bo Bollinger Bands Indicator Review

Bo Bollinger Bands Indicator is a technical analysis tool used in trading to determine the volatility of securities. It was developed by John Bollinger, a renowned technical analyst, and trader.

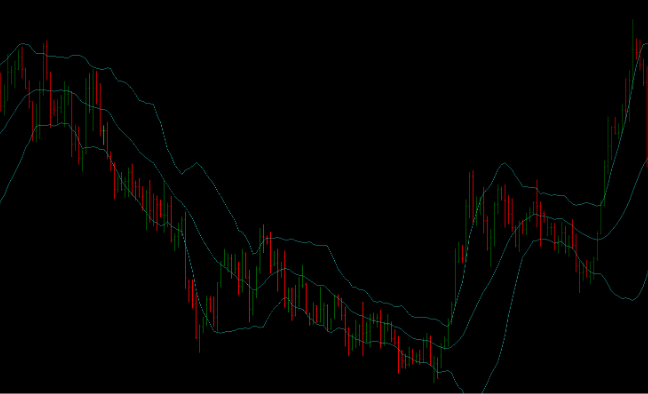

The Bo Bollinger Bands Indicator consists of three lines that are plotted on the price chart of a security: the upper band, lower band, and middle line. The middle line is a moving average while the upper and lower bands represent standard deviations from this moving average.

Download Free Bo Bollinger Bands Indicator

The Bo Bollinger Bands Indicator is widely used by traders to identify potential buy or sell signals. When prices move above or below the upper or lower bands respectively, it may indicate an overbought or oversold condition which could lead to a reversal in price direction. Moreover, when prices touch one of the bands, it may signal a potential trend reversal or continuation.

Understanding how to use this indicator effectively can help traders make informed decisions about their trades and improve their overall profitability. This article will provide an overview of the Bo Bollinger Bands Indicator and discuss how to use it in trading as well as tips for maximizing its effectiveness.

Understanding the Bo Bollinger Bands Indicator

The application of technical analysis in financial markets has led to the development of various tools, including a widely used method known as Bollinger Bands, which employs statistical techniques to analyze market trends and identify potential trading opportunities.

The Bo Bollinger Bands Indicator is an advanced version that offers additional features compared to traditional Bollinger Bands. It was developed by John Bollinger, who created the original indicator in the 1980s.

Bo Bollinger Bands are similar to traditional bands but have a few key differences. They offer more accurate signals due to its double-standard deviation formula and incorporate volume data in their calculations. Additionally, they include four different bands instead of two found in traditional versions: the upper band, lower band, moving average (center) band, and an outer channel that represents one standard deviation away from the center line.

To interpret Bo Bollinger Bands correctly, traders should note that when prices touch or break through either of the outer bands, it indicates overbought or oversold conditions respectively. However, this does not necessarily imply a trend reversal; rather it may be a signal for traders to consider entering/exiting positions with caution.

Common mistakes when using Bo Bollinger Bands include interpreting them too rigidly without considering price action dynamics and ignoring other technical indicators such as momentum oscillators or support/resistance levels at critical price levels before making trading decisions based solely on BB signals.

Using the Bo Bollinger Bands Indicator in Trading

The practical application of the Bollinger Bands indicator in trading involves monitoring price movements within a range defined by the upper and lower bands, potentially indicating points of reversal or continuation.

The following are some trading strategies that can be used with the Bo Bollinger Bands Indicator to identify potential entry and exit points:

- Breakout Trading Strategy: This strategy looks for moments when prices break above or below the upper or lower band, respectively, which may indicate an upcoming trend reversal. In this case, traders may enter a long position when prices break above the upper band and exit when they move back into the range.

- Momentum Trading Strategy: The momentum strategy aims to take advantage of strong upward or downward trends that occur after significant price moves outside of the Bollinger Bands’ range. Traders may enter a long position when prices move above the upper band during an uptrend, and exit when they start to decline towards it.

- Mean Reversion Trading Strategy: This strategy assumes that prices will eventually revert to their mean after moving outside of its usual range as indicated by the indicator’s bands. Traders may enter a short position if prices rise above the upper band and then fall back into it again, anticipating a return to normal levels.

Overall, incorporating risk management techniques like stop-loss orders is crucial for successful trading with any strategy utilizing Bollinger Bands indicators due to their volatility potential.

Tips for Maximizing the Bo Bollinger Bands Indicator

Maximizing the potential of the Bo Bollinger Bands Indicator requires traders to avoid common mistakes, such as using it in isolation or failing to adjust its settings appropriately. While this versatile tool can provide valuable insights into market volatility and trend reversals, it is not foolproof and should be used in conjunction with other indicators and trading strategies. For example, combining Bollinger Bands with support and resistance levels or oscillators like RSI (Relative Strength Index) can help traders confirm signals and filter out false positives.

Advanced strategies for using the Bo Bollinger Bands Indicator include identifying squeeze patterns, which occur when volatility reaches unusually low levels before large price movements. Traders can also use multiple timeframes to get a more comprehensive view of market dynamics, analyzing longer-term trends alongside short-term price action. Additionally, applying different types of moving averages (such as exponential or weighted) can generate more accurate signals by smoothing out noise and reducing lag time. By tailoring their approach to specific market conditions and continuously refining their analysis techniques, traders can maximize the effectiveness of this popular indicator.

| Advantages | Disadvantages |

|---|---|

| – Can identify trend reversals – Offers insights into market volatility – Versatile tool that can be combined with other indicators |

– Not always reliable in choppy markets – Can produce false signals if used in isolation – Requires constant adjustments based on changing market conditions |

Conclusion

The Bo Bollinger Bands Indicator is a popular tool among traders. It helps determine the price volatility and potential trend reversals of a security.

By using this indicator, traders can identify potential entry and exit points for their trades. However, it is important to note that no single indicator should be relied on solely when making trading decisions. It should be used in conjunction with other technical analysis tools, fundamental analysis, and market research.

To maximize the effectiveness of the Bo Bollinger Bands Indicator, traders should consider adjusting the parameters to fit their specific trading style and preferences. They should also keep in mind that it is not foolproof and may provide false signals at times. Therefore, it is important to have a solid understanding of how it works and use it in combination with other indicators for more accurate results.

Overall, the Bo Bollinger Bands Indicator can be a valuable tool for traders looking to analyze price movements and trends in the market. With proper usage and consideration of its limitations, this indicator can aid in making informed trading decisions.