Bande Di Bollinger Osma Indicator Mt4 Review

Technical analysis is a widely used tool in the financial markets to identify trends and potential trading opportunities. One of the most popular indicators used by traders is the Bollinger Bands, which helps them to measure volatility and price movements.

Another commonly used indicator is the OsMA (Moving Average of Oscillator), which measures the difference between an oscillator and its moving average. In this article, we will delve into the details of both these indicators and explain how they can be combined to create an effective trading strategy.

Download Free Bande Di Bollinger Osma Indicator Mt4

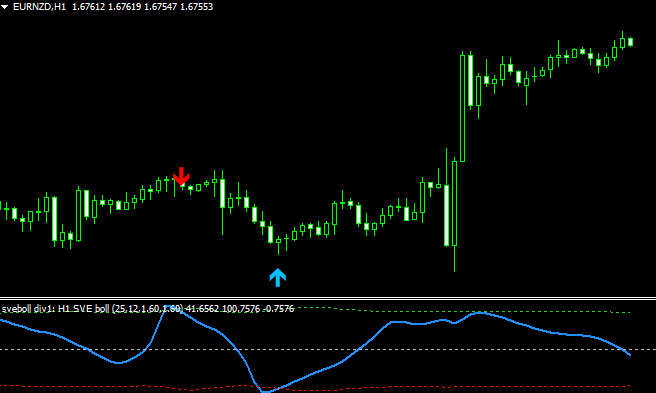

The Bande di Bollinger OsMA Indicator MT4 is a combination of two powerful indicators that help traders make informed decisions about buying or selling assets. This indicator combines the strengths of Bollinger Bands and OsMA to provide a comprehensive view of market conditions.

By using this indicator, traders can easily identify trend reversals, overbought or oversold conditions, as well as potential breakouts or breakdowns in price movement. With this information at their disposal, traders can make sound trading decisions based on facts rather than emotions or speculation.

Understanding the Bollinger Bands Indicator

The Bollinger Bands Indicator is a popular technical analysis tool that utilizes moving averages and standard deviations to identify potential trends and price volatility in financial markets.

The indicator consists of three lines: the middle band, which is a simple moving average (SMA), and two outer bands, which are calculated by adding and subtracting a multiple of the standard deviation from the middle band.

This creates a channel around the price action that can help traders identify overbought or oversold conditions and anticipate potential breakouts.

The Bollinger band calculation is based on the assumption that prices tend to revert to their mean after deviating from it, making it useful for trend-following as well as counter-trend strategies.

Traders can also use volatility analysis techniques such as chart patterns, candlestick formations, and momentum indicators to confirm or diverge from Bollinger Band signals.

However, like any other technical indicator, Bollinger Bands should not be used in isolation but rather in conjunction with other tools and risk management strategies to maximize their effectiveness.

Understanding the OsMA Indicator

A comprehensive understanding of the OsMA indicator is essential to accurately interpret market momentum and identify potential trade opportunities.

The OsMA (or Moving Average of Oscillator) is a technical analysis tool that measures the difference between an oscillator (such as MACD) and its moving average. It helps traders to identify changes in momentum by giving early indications of trend reversals or continuations.

The calculation of OsMA values involves subtracting the longer-term moving average from the shorter-term moving average of an oscillator, such as MACD. A positive value indicates bullish momentum, while a negative value indicates bearish momentum.

Traders also use divergences between price action and OsMA signals as potential trading opportunities. For instance, when prices make higher highs while OsMA makes lower lows, it may indicate a bearish divergence and a possible reversal in price direction.

Overall, interpreting OsMA signals requires knowledge of both technical analysis principles and market conditions to make informed decisions about trades.

How to Use the Bande di Bollinger OsMA Indicator MT4

Combining the Bande di Bollinger and OsMA indicators can provide a comprehensive analysis of market trends and potential trading opportunities.

This is because the Bande di Bollinger indicator provides information about market volatility, while the OsMA indicator measures momentum.

By using these two indicators together, traders can identify potential entry and exit points for trades.

However, it is important to use best practices when incorporating these indicators into trading strategies, such as considering other technical analysis tools and managing risk appropriately.

Combining the two indicators to analyze the market

By leveraging the complementary strengths of two distinct technical analysis tools, traders can gain a more comprehensive understanding of market trends and make data-driven decisions accordingly.

One such combination is the Bande di Bollinger and OsMA indicator MT4. The former is a volatility-based technical analysis tool that uses three lines to plot the upper, lower, and middle band based on the standard deviation of price movements over a certain period. Meanwhile, the latter measures momentum by calculating the difference between a shorter and longer moving average.

When combined, these indicators can provide valuable trading signals for investors. For example, if prices are trading near the upper Bollinger band and OsMA shows an overbought condition with declining momentum, it may signal a potential reversal or correction in price.

Conversely, if prices are near the lower Bollinger band while OsMA indicates oversold conditions with increasing momentum, it could suggest an opportunity for buying at a low price point. However, it’s important to note that different indicator settings may produce varying results depending on market conditions and individual preferences. As such, traders should experiment with different combinations of parameters to find what works best for them.

Identifying potential trading opportunities

Analyzing market trends through the combination of technical analysis tools can assist traders in identifying potential trading opportunities that may elicit a sense of confidence and informed decision-making.

By combining the Bands of Bollinger and OSMA (Oscillator of Moving Average) indicators, traders can gain a more comprehensive understanding of the overall market trend and volatility.

The Bands of Bollinger indicator is used to measure the volatility of an asset by showing its upper and lower limits based on standard deviations from its moving average, while the OSMA indicator uses two moving averages to analyze momentum.

One way to identify potential trading opportunities is by looking for situations where price movements deviate from their normal range. This could mean that an asset’s price has reached either its upper or lower limit as defined by the Bands of Bollinger indicator, suggesting that it may be due for a reversal in direction.

Additionally, if the OSMA line crosses above or below its signal line, this could indicate either bullish or bearish momentum respectively, providing further insight into whether a trade should be taken. Overall, utilizing technical analysis tools such as these can help traders make more informed decisions when entering or exiting trades.

Best practices for using the indicator in trading strategies

Understanding the best practices for implementing technical analysis tools such as measuring market trends and volatility can help traders make more informed decisions when entering or exiting trades.

When using the Bande di Bollinger OsMA indicator in trading strategies, it is recommended to use multiple time frames to confirm potential trading opportunities. This involves analyzing charts on different time frames, such as daily, hourly, and 15-minute intervals, to ensure that price movements align with the intended trade direction.

Another best practice for using this indicator is backtesting strategies. Backtesting involves testing a strategy against historical data to determine its effectiveness before applying it in live trading. This allows traders to identify any flaws in their strategy and make adjustments accordingly.

It is essential to also consider other factors that may affect the market, such as economic news releases or geopolitical events when developing a trading plan. By following these best practices, traders can increase their chances of making profitable trades while minimizing risks associated with uncertainty in the financial markets.

Conclusion

In conclusion, the Bande di Bollinger OsMA Indicator MT4 is a powerful tool for traders in predicting market trends. The combination of two popular indicators, Bollinger Bands and OsMA, provides a more accurate representation of the market’s momentum and volatility.

It allows traders to identify potential entry and exit points in their trades, making it easier to manage risk and maximize profits. However, as with any trading tool or strategy, it is important to exercise caution and conduct thorough analysis before making any trades.

The Bande di Bollinger OsMA Indicator MT4 should be used in conjunction with other technical indicators and fundamental analysis to make well-informed decisions. With proper usage and understanding of this indicator, traders can increase their chances of success in the forex market.