Ay Market Profile Dwm Rev2 Indicator Mt4 Review

The AY Market Profile DWM REV2 Indicator MT4 is a tool designed to help traders better understand market movements by providing valuable insights into the behavior of certain assets.

Developed specifically for MetaTrader 4, this indicator utilizes the concept of market profile analysis to provide traders with a deeper understanding of price and volume data.

Market profile analysis is a powerful way to interpret market data and understand how prices are forming within a given timeframe.

Download Free Ay Market Profile Dwm Rev2 Indicator Mt4

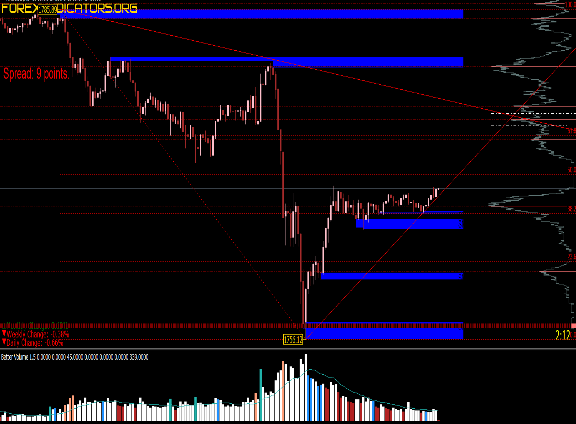

By breaking down the trading day into individual periods or timeframes, market profile charts can help identify key areas of support and resistance, as well as potential breakout points.

The AY Market Profile DWM REV2 Indicator MT4 takes this concept one step further by providing an automated system that allows traders to easily analyze markets and make informed decisions based on objective data.

In this article, we will explore the benefits of using this powerful tool and how it can be integrated into your trading strategy to improve your overall performance in the markets.

Understanding the Market Profile Concept

The concept of market profile is a widely utilized analytical tool that provides traders with an in-depth understanding of the market’s structure and dynamics, enabling them to make informed decisions based on objective data rather than emotion or speculation.

Market profile strategies involve analyzing the volume and price levels at which trading occurs to identify key support and resistance levels, as well as areas of accumulation or distribution. By understanding these levels, traders can anticipate potential buying or selling pressure, leading to profitable trades.

Volume analysis techniques are an essential component of market profile strategies. Volume analysis involves studying the number of shares or contracts traded at each price level over time to identify patterns and trends.

This information can help traders determine areas of high liquidity and volatility, allowing them to predict potential breakouts or reversals in the market. Additionally, volume analysis can be used to confirm other technical indicators such as moving averages or trend lines, providing further confirmation for traders’ decisions.

Overall, understanding market profile concepts and utilizing volume analysis techniques can provide a significant advantage for traders looking to make informed decisions in today’s rapidly changing markets.

Benefits of Using the AY Market Profile DWM REV2 Indicator MT4

Analyzing market trends becomes easier with the AY Market Profile DWM REV2 Indicator MT4. It provides a comprehensive view of price movements, volume, and time frame. The indicator allows traders to identify key support and resistance levels that can be used to make informed trading decisions.

By using this tool, traders can gain deeper insights into the market. Additionally, they can potentially improve their profitability through better trade execution.

Analyzing market trends

An examination of market trends sheds light on the historical behavior and potential future movements in financial markets.

To analyze trends, traders use various techniques such as technical analysis, fundamental analysis, and market profile strategies.

Technical analysis involves analyzing price charts to identify patterns and indicators that suggest a trend is forming or about to change.

Fundamental analysis looks at the underlying economic and financial factors that affect the market’s direction.

Market profile strategies are also useful tools for analyzing trends.

The AY Market Profile DWM REV2 Indicator MT4 provides an efficient way to gather information on market activity and participant behavior.

This indicator allows traders to view detailed information about where buyers and sellers are entering the market, which can help them anticipate future price movements.

By using this indicator alongside other trend analysis techniques, traders can make more informed decisions about when to enter or exit trades based on current market conditions.

Overall, analyzing market trends is essential for successful trading in financial markets, and using tools like the AY Market Profile DWM REV2 Indicator MT4 can provide valuable insights into these trends.

Identifying key support and resistance levels

Identifying key support and resistance levels is a crucial aspect of technical analysis that allows traders to determine the points at which buying or selling activity is likely to be strong enough to affect price movement, providing a basis for entry and exit decisions.

The concept of support and resistance levels is based on the idea that markets tend to move in trends, with prices moving up or down until they encounter a level of opposing pressure.

Support levels are defined as areas where buyers have historically been willing to enter the market and push prices higher, while resistance levels reflect zones where sellers have previously entered the market and pushed prices lower.

One popular method for identifying support and resistance levels is through the use of pivot points. Pivot points are calculated using previous high, low, and closing prices, with several different formulas available depending on the trader’s preference.

Once pivot points have been determined, traders can look for key support and resistance levels based on these calculations. Other methods for identifying these important areas include trend analysis using chart patterns such as trendlines or moving averages.

Regardless of the approach taken by traders, correctly identifying key support and resistance levels can provide valuable insights into potential price movements that can inform trading strategies.

Making informed trading decisions

In order to make informed trading decisions, it is important for traders to consider a range of factors beyond simply identifying key support and resistance levels.

Technical analysis and fundamental analysis are two approaches that traders can use to evaluate market conditions. Technical analysis involves using past price and volume data to identify patterns and trends that can help predict future price movements. On the other hand, fundamental analysis involves examining economic, financial, and political factors that could impact the value of an asset.

Traders must also determine whether they will adopt a long-term or short-term trading strategy. Long-term traders typically hold positions for weeks or months, and they rely on fundamental analysis to identify undervalued assets with strong growth potential. Short-term traders focus on technical indicators such as moving averages, momentum oscillators, trendlines, and chart patterns in order to take advantage of short-lived market inefficiencies.

Ultimately, successful trading requires discipline when implementing a chosen strategy while continuously adjusting based on new information about the markets.

Integration with MetaTrader 4

Integration with MetaTrader 4 is a crucial aspect of modern trading strategies.

In order to ensure ease of installation and setup, it is important to choose an indicator that has clear instructions and a user-friendly interface.

Compatibility with existing trading strategies is also essential, as traders often rely on multiple indicators to make informed decisions about their trades.

Easy installation and setup

The section on installation and setup of the AY Market Profile DWm Rev2 provides clear and concise instructions to facilitate an easy and efficient process.

The indicator can be easily installed through the MetaTrader 4 platform by copying the file into the ‘Indicators’ folder. However, for those who are unfamiliar with this process, there are several installation tips listed in the guide that can help to ensure a smooth installation process. These include ensuring that the MT4 platform is closed before installing, double-checking the file location, and restarting MT4 after installation.

In addition to providing useful installation tips, the guide also includes a troubleshooting guide for common issues that may arise during setup. This includes solutions to problems such as missing files or incorrect settings.

Overall, these resources make it easier for traders of all levels to install and set up this powerful market profile indicator without experiencing any major difficulties or complications.

Compatibility with existing trading strategies

Compatibility with various trading strategies is an important aspect to consider when choosing a tool for technical analysis, and the AY Market Profile DWm Rev2 offers flexibility in this regard by being compatible with a wide range of existing trading strategies. Traders can combine this indicator with other technical indicators to create customized trading strategies that suit their preferences and risk appetite. For instance, combining the AY Market Profile DWm Rev2 indicator with moving averages or oscillators can help traders identify potential entry and exit points in the market.

Furthermore, backtesting results have shown that the AY Market Profile DWm Rev2 indicator can be used effectively in different market conditions such as trending or ranging markets. This means that traders can use this tool to analyze price action and make informed decisions regardless of market volatility. The table below shows some popular trading strategies that traders can use in combination with the AY Market Profile DWm Rev2 indicator:

| Trading Strategy | Indicator Combination | Expected Outcome |

|---|---|---|

| Trend Following | AY MPDWm + Moving Average | Identify trend direction |

| Mean Reversion | AY MPDWm + RSI / Stochastic Oscillator | Identify oversold/overbought levels |

| Breakout Trading | AY MPDWm + Bollinger Bands | Identify breakouts from consolidation |

Overall, compatibility with existing trading strategies is an important factor to consider when choosing a technical analysis tool, and the AY Market Profile DWm Rev2 offers versatility in this regard. Traders should experiment with combining different indicators to find a strategy that works best for them while using the AY Market Profile DWm Rev2 as part of their analysis toolkit.

Conclusion

The AY Market Profile DWM REV2 Indicator MT4 is a powerful tool for traders who want to understand the market profile concept. By analyzing the volume and price data of specific time periods, this indicator can provide valuable insights into market trends and potential price movements. Its integration with MetaTrader 4 makes it easy to use for traders who are already familiar with the platform.

One of the main benefits of using this indicator is that it helps traders identify key support and resistance levels more easily. This information can be used to make better trading decisions, such as determining optimal entry and exit points, or setting stop-loss orders at appropriate levels.

Additionally, by providing a visual representation of the market profile, this tool allows traders to quickly see which areas of the market are most active, potentially indicating where price movements might occur in the future.

Overall, the AY Market Profile DWM REV2 Indicator MT4 is a valuable tool for any trader looking to improve their understanding of market trends and potential price movements. Its intuitive interface and integration with MetaTrader 4 make it easy to use, while its powerful analytical capabilities provide valuable insights that can help traders make smarter trading decisions. Whether you’re a seasoned pro or just getting started in trading, this indicator is definitely worth considering for your toolkit.