Automatic Parabolic Support/Resistance Levels Mt4 Indicator Review

Technical analysis is an integral part of trading that involves the use of charts and indicators to identify potential market trends. One of the key components of technical analysis is identifying support and resistance levels, which are areas on a chart where buying or selling pressure may be present.

However, manually identifying these levels can be time-consuming and prone to errors. This is where automatic support/resistance indicators come in handy, as they can quickly and accurately identify these levels for traders.

Download Free Automatic Parabolic Support Resistance Levels Mt4 Indicator

One such indicator is the Automatic Parabolic Support/Resistance Levels MT4 Indicator, which uses parabolic curves to plot potential support and resistance levels on a chart. This indicator offers several benefits over traditional methods of identifying support and resistance levels, including increased accuracy, speed, and convenience.

In this article, we will explore how this indicator works and how it can be incorporated into your trading strategy to improve your overall trading performance.

The Benefits of Using an Automatic Support/Resistance Indicator

The utilization of an automated indicator for identifying key levels on price charts can provide traders with several advantages. One such benefit is the ability to save time and effort that would otherwise be spent manually identifying support and resistance levels.

Automating this process allows traders to focus on other aspects of their analysis, such as trend identification, pattern recognition, or fundamental analysis. Moreover, automated support/resistance indicators can help traders avoid common errors associated with manual identification.

These errors may include subjective bias in selecting levels or inconsistencies in the placement of lines across multiple timeframes. An automatic indicator can eliminate these issues by applying a consistent and objective methodology based on price action data.

Examples of popular automatic support/resistance indicators include pivots points, Fibonacci retracements/extensions, and moving averages. By incorporating these tools into their trading strategy, traders can improve their decision-making process and increase their chances of success in the market.

How the Automatic Parabolic Support/Resistance Levels Indicator Works

This section elucidates the underlying mechanism employed by the technical analysis tool to generate dynamic price levels that are capable of reflecting market trends in real-time.

The automatic parabolic support/resistance levels MT4 indicator is a technical analysis tool designed to identify potential areas of support and resistance based on recent price movements. It utilizes the indicator settings and market analysis techniques to generate signals that help traders make informed trading decisions.

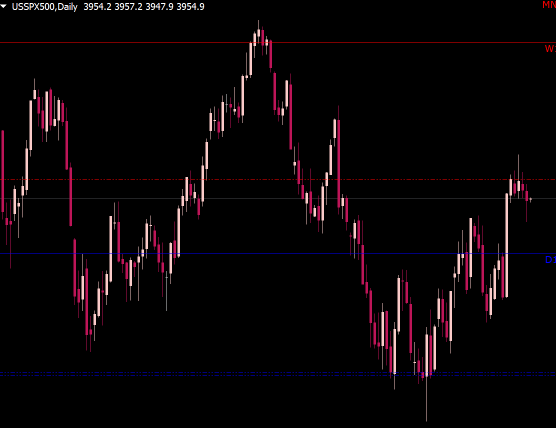

The indicator works by plotting dots above or below the price chart, depending on whether the trend is bullish or bearish, respectively. These dots represent potential areas of support and resistance, which traders can use as entry or exit points for their trades.

As the market moves, these dots move with it, creating dynamic support and resistance levels that adapt to changing market conditions. This allows traders to stay ahead of the curve by identifying key areas where price action may reverse or continue its current trend.

Overall, this tool provides a valuable resource for traders looking to gain an edge in today’s fast-paced markets.

How to Incorporate the Indicator into Your Trading Strategy

Incorporating the technical analysis tool discussed here into one’s trading strategy requires a thorough understanding of how it works, as well as an ability to interpret the signals generated by the indicator.

Once traders have a grasp of these fundamentals, they can begin to customize their approach based on their individual market preferences and risk tolerance levels. Some popular trading examples include using the automatic parabolic support/resistance levels indicator in conjunction with other technical analysis tools like moving averages or trend lines.

Another customization option is adjusting the parameters of the indicator itself. For example, traders may choose to alter the sensitivity of the indicator by changing its acceleration factor or maximum step value. This can help fine-tune its accuracy for specific markets or timeframes.

Additionally, some traders may prefer to use this tool for identifying potential entry or exit points in their trades, while others may rely on it more heavily as a confirmation signal for existing positions. Ultimately, incorporating this indicator into one’s trading strategy requires careful consideration and experimentation to determine what works best for each individual trader’s style and goals.

Conclusion

In conclusion, incorporating an automatic support/resistance indicator into your trading strategy can provide several benefits. It eliminates the need for manual analysis and saves time while also providing accurate levels based on market conditions.

The Automatic Parabolic Support/Resistance Levels Indicator is one such tool that uses parabolic curves to identify key levels in the market. The indicator works by analyzing price movements and drawing curves around them, which act as dynamic support and resistance levels. These levels are not static but move with the market, making it easier for traders to adapt their strategies accordingly.

By using this indicator, traders can make more informed decisions and improve their trading outcomes. Overall, incorporating an automatic support/resistance tool like the Automatic Parabolic Support/Resistance Levels Indicator can enhance a trader’s ability to navigate the markets successfully.