Auto Trend Channels Indicator Mt4 Review

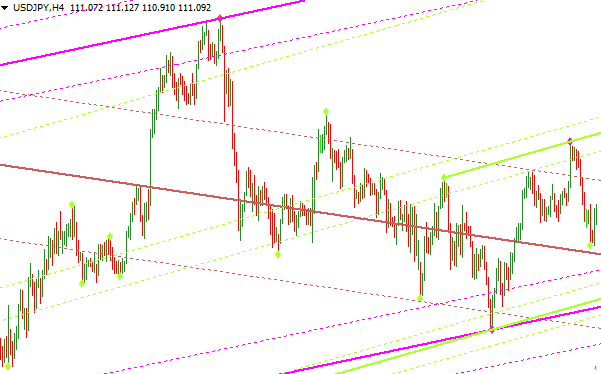

The Auto Trend Channels Indicator MT4 is a popular technical analysis tool used by traders to identify trends in the market. It is a powerful indicator that helps traders make informed decisions about when to enter or exit trades based on trend analysis.

The indicator is designed to automatically detect and draw trend lines on chart patterns, making it easy for traders to identify price channels. In this article, we will explore the basics of the Auto Trend Channels Indicator MT4 and how it can be incorporated into your trading strategy. We will also provide tips for maximizing its effectiveness and discuss some of its potential limitations.

Download Free Auto Trend Channels Indicator Mt4

By understanding this powerful tool, you can gain an edge in the markets and improve your overall trading performance.

Understanding the Auto Trend Channels Indicator MT4

A thorough understanding of the technical analysis tools available in MetaTrader 4 can enhance a trader’s ability to identify trends, and the Auto Trend Channels indicator is one such tool that can assist traders in analyzing price movements.

This MT4 indicator is designed to provide traders with a visual representation of price channels, which are formed by plotting parallel lines around the highs and lows of an asset’s price action. Traders can customize the settings for this indicator to suit their trading style, including adjusting the period length, color scheme, and line thickness.

Interpreting signals from the Auto Trend Channels indicator involves identifying key support and resistance levels within the price channel. When prices move towards or breach these levels, it may indicate potential trend reversals or breakouts.

Additionally, traders can look for patterns within the channel itself, such as ascending or descending channels that may suggest bullish or bearish market conditions respectively.

By incorporating this technical analysis tool into their trading strategy alongside other indicators and fundamental analysis factors, traders can gain a more comprehensive view of market trends and make informed trading decisions.

Using the Auto Trend Channels Indicator MT4 in Your Trading Strategy

Identifying trends and support/resistance levels is a crucial aspect of successful trading. The Auto Trend Channels Indicator MT4 can be a useful tool in this regard. By detecting trend lines automatically, it enables traders to make informed decisions about entering or exiting trades.

Additionally, managing risk is essential to prevent losses and maximize profits. Incorporating the indicator into one’s overall risk management strategy can help achieve this goal.

Identifying Trends and Support/Resistance Levels

The section focuses on the crucial task of determining trends and support/resistance levels, providing valuable insights for traders seeking to make informed decisions.

The Auto Trend Channels Indicator MT4 is a useful tool in identifying these critical components of technical analysis. Traders can use this indicator to plot trend lines based on the highs and lows of price movements over a specific period.

In addition, traders can use multiple time frames to identify trend reversals accurately. For example, if an asset is trending upwards on the daily chart but showing signs of a reversal on the four-hour chart, it may be wise to consider taking profits or closing positions rather than holding onto them.

By using different time frames in conjunction with the Auto Trend Channels Indicator MT4, traders can get a more comprehensive view of market trends and make better trading decisions accordingly.

Entering and Exiting Trades

The current section delves into the critical process of entering and exiting trades, which entails analyzing market conditions, identifying potential entry points based on technical indicators, setting stop-loss orders to minimize losses, and taking profits at predetermined levels.

Using stop losses is an important aspect of risk management that can help traders limit their losses when the market moves against them. Stop loss orders are placed below the entry price for long positions and above the entry price for short positions. If prices fall below or rise above these levels, the trade will be automatically closed out.

Identifying entry and exit signals is another crucial element in trading success. There are several technical indicators that traders can use to identify trends and potential reversal points. Some popular indicators include moving averages, Bollinger Bands, Relative Strength Index (RSI), and MACD. Traders may also use chart patterns such as head and shoulders or double bottoms to identify potential entry or exit points.

Once a trader has identified a signal to enter a trade, they should carefully consider their risk-reward ratio before placing an order. This involves determining how much they stand to gain if the trade goes in their favor compared with how much they could lose if it doesn’t go as planned.

By following a systematic approach to entering and exiting trades, traders can improve their chances of success in the markets.

Managing Risk

Effective risk management is crucial for traders to minimize potential losses and achieve long-term success in their trading strategies. Risk management techniques involve identifying and assessing potential risks, implementing strategies to mitigate those risks, and monitoring the outcomes of those strategies over time. One important aspect of risk management is position sizing, which involves determining the amount of capital to allocate to each trade based on one’s risk tolerance and overall portfolio size. By utilizing position sizing strategies such as fixed fractional position sizing or percent risk per trade, traders can limit their exposure to individual trades and avoid risking too much of their capital at once.

To further illustrate the importance of effective risk management in trading, consider the following table:

| Trade # | Entry Price | Stop Loss | Target Profit | Risk (R) |

|---|---|---|---|---|

| 1 | $100 | $95 | $110 | 1R |

| 2 | $75 | $70 | $85 | 0.5R |

| 3 | $50 | $45 | $60 | 0.25R |

| 4 | $125 | $120 | $140 | -0.5R |

In this example, a trader has entered four trades with varying levels of risk and reward potential. The first trade had a target profit that was twice the amount of its initial risk (1:2), while subsequent trades had progressively smaller reward-to-risk ratios. Trade #4 had a negative R value, indicating that it violated the trader’s maximum acceptable loss threshold for any given trade. By adhering to robust risk management practices such as these, traders can better manage their portfolios over time by limiting downside risks while still taking advantage of profitable opportunities when they arise.

Tips for Maximizing the Effectiveness of the Auto Trend Channels Indicator MT4

To enhance the precision of utilizing the Auto Trend Channels Indicator MT4, employing an optimal trading strategy that aligns with the generated signals could potentially maximize the effectiveness of its functionality.

One way to do this is by incorporating backtesting results into your trading plan. By simulating and analyzing past market conditions using historical data, traders can evaluate their chosen strategies and determine their efficacy in different scenarios. This allows for a more informed decision-making process when it comes to executing trades based on the indicator’s signals.

Another way to optimize the use of this tool is by taking advantage of customization options available within the indicator itself. MT4 offers various settings that can be adjusted according to individual preferences and risk tolerance levels.

For instance, you can customize how often new channels are drawn or set specific parameters for entry and exit points. These features allow traders to tailor their use of this analytical tool according to their unique trading styles, increasing its relevance and accuracy in identifying potential market trends.

Conclusion

The Auto Trend Channels Indicator MT4 is a powerful tool for traders looking to identify trends in the market. By analyzing price movements over time and drawing trend lines, this indicator can help traders predict future price movements with greater accuracy.

However, like any trading tool, it is essential to use the Auto Trend Channels Indicator MT4 in conjunction with other indicators and analysis techniques to maximize its effectiveness.

To get the most out of the Auto Trend Channels Indicator MT4, traders should incorporate it into a comprehensive trading strategy that includes risk management, position sizing, and exit rules.

Additionally, traders should continually monitor their trades and adjust their strategies as needed based on changing market conditions.

With proper use and careful attention to detail, the Auto Trend Channels Indicator MT4 can be an invaluable asset for any trader seeking long-term success in the forex market.