Auto Fibonacci Fan Indicator Mt4 Review

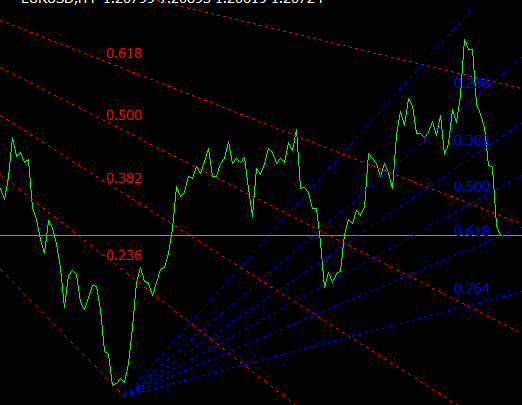

The Auto Fibonacci Fan Indicator MT4 is a technical analysis tool that traders use to identify potential support and resistance levels in the market. This indicator is built on the principles of Fibonacci retracement levels, which are based on the idea that price movements tend to retrace a predictable portion of their previous move before continuing in the same direction.

Fibonacci retracements are calculated by identifying two extreme points on a chart, usually a high and a low, and then dividing the vertical distance between these points into several key ratios. These ratios include 23.6%, 38.2%, 50%, 61.8%, and 78.6%.

Download Free Auto Fibonacci Fan Indicator Mt4

Traders use these ratios to identify potential areas of support or resistance where prices may bounce back or reverse direction. The Auto Fibonacci Fan Indicator MT4 takes this concept one step further by drawing diagonal lines from each key ratio level to create a fan-like pattern on the chart, making it easier for traders to visualize potential support and resistance zones at various angles.

In this article, we will explore the features of the Auto Fibonacci Fan Indicator MT4 and how traders can incorporate it into their trading strategies for better decision-making.

Understanding Fibonacci Retracement Levels

The comprehension of Fibonacci retracement levels is crucial for traders seeking to identify potential support and resistance levels in financial markets based on the notion that prices tend to retrace a predictable portion of a move.

Fibonacci ratios are calculated by dividing one number in the sequence by another, creating percentages that represent potential retracement levels. These levels are often used as technical indicators to predict price movements in trading.

Interpreting market trends using Fibonacci retracement levels involves identifying significant highs and lows in the chart and plotting the corresponding retracement levels. Traders then analyze the chart to see if these levels align with other technical or fundamental indicators, such as moving averages or economic news releases.

By combining different analytical tools, traders can gain a better understanding of market trends and make informed decisions about when to enter or exit trades. The use of automated indicators, such as an auto Fibonacci fan indicator MT4, can also help simplify this process and provide real-time updates on potential trading opportunities.

Features of the Auto Fibonacci Fan Indicator MT4

This section outlines the notable characteristics of the automated tool that calculates Fibonacci ratios and projects trend lines to identify potential areas of support and resistance in financial markets. The Auto Fibonacci Fan Indicator MT4 is a powerful trading tool that traders can use to make informed decisions about entering or exiting trades.

Some of its key features include:

- Customizing settings: Traders can customize the indicator’s parameters such as the number of retracement levels, color schemes, and drawing styles based on their preferences.

- Accurate projections: The indicator uses advanced mathematical algorithms to calculate Fibonacci ratios and project trend lines with high accuracy.

- Backtesting results: Traders can test the effectiveness of their trading strategies by backtesting them using historical data before implementing them in real-time trading.

Overall, the Auto Fibonacci Fan Indicator MT4 provides traders with a comprehensive set of tools for analyzing market trends and identifying potential areas of support and resistance. Its customizable settings, accurate projections, and backtesting capabilities make it a valuable asset for any trader looking to improve their chances of success in financial markets.

How to Use the Auto Fibonacci Fan Indicator MT4 in Your Trading Strategy

Identifying Support and Resistance Levels is an important aspect of any trading strategy. The Auto Fibonacci Fan Indicator MT4 can be used to identify these levels by drawing trendlines from swing highs and lows. Once these levels are identified, traders can use them to enter or exit trades based on the price action around them.

Setting Price Targets is another crucial component of a successful trading strategy. The Auto Fibonacci Fan Indicator MT4 can assist with this by providing potential price targets based on the Fibonacci ratios. Traders can use these targets as a guide for taking profits or setting stop losses.

Combining with Other Technical Analysis Tools can enhance the effectiveness of the Auto Fibonacci Fan Indicator MT4 in a trading strategy. Traders may choose to use other indicators such as moving averages or oscillators to confirm signals given by the indicator or to identify additional entry and exit points in the market.

Identifying Support and Resistance Levels

Examining price levels where market changes direction can aid in determining areas of support and resistance when utilizing technical analysis. This is crucial in Fibonacci Fan Trading as the indicator relies heavily on identifying these key levels.

Support refers to a level at which demand for an asset is strong enough to prevent its price from falling further, while resistance refers to a level at which supply of an asset is strong enough to prevent its price from rising further. These levels are important because they provide traders with potential entry and exit points for their trades.

The Importance of Support and Resistance lies in their ability to show traders the psychological barriers that buyers and sellers face when trading a particular asset. When an asset reaches a support or resistance level, traders may expect the trend to reverse or continue, respectively.

Moreover, these levels serve as indicators of market sentiment by reflecting how traders perceive the value of an asset. By incorporating Fibonacci Fan Trading into one’s strategy, traders may gain insights into possible movements in the market based on where support and resistance levels fall along the fan lines drawn by the indicator.

Overall, understanding support and resistance can be useful for any trader looking to capitalize on market trends using technical analysis tools like Fibonacci Fan Trading.

Setting Price Targets

Setting price targets is a critical aspect of technical analysis that aids traders in determining potential profit margins and minimizing losses. When using Fibonacci fan for trend analysis, traders can identify key levels of support and resistance to set price targets.

The Fibonacci fan indicator plots diagonal lines based on the Fibonacci sequence, which can help traders visualize potential levels where prices may reverse or continue trending. Applying Fibonacci fan in swing trading involves identifying a swing high and low point in the chart and drawing the diagonal lines accordingly.

Traders can then use these lines to determine potential profit targets as well as stop loss levels. Additionally, traders often look for confluence between Fibonacci levels and other technical indicators such as moving averages or trendlines to confirm their analysis before setting price targets.

Ultimately, the use of Fibonacci fan in setting price targets can be a valuable tool for traders looking to maximize profits while minimizing risk.

Combining with Other Technical Analysis Tools

The use of Fibonacci fan in conjunction with other technical analysis tools can provide traders with a more comprehensive understanding of market trends and potential price movements.

One common trading mistake to avoid when using Fibonacci tools is solely relying on them for making trading decisions. It is important to combine them with other indicators, such as trend lines, moving averages, or oscillators, to confirm signals and reduce the likelihood of false breakouts or reversals.

Using the auto Fibonacci fan indicator in conjunction with trend lines is one example of combining two different technical analysis tools. Trend lines are drawn between two or more significant highs or lows and can indicate the direction of a trend.

By adding a Fibonacci fan to this chart, traders can identify potential support and resistance levels based on key retracement levels that coincide with the trend line. This combination can help traders determine entry and exit points for trades as well as manage risk by identifying stop loss levels.

Conclusion

In conclusion, the Auto Fibonacci Fan Indicator MT4 is a powerful tool that can help traders identify potential levels of support and resistance in their trading strategies.

By using the Fibonacci retracement levels as a basis for drawing trend lines, this indicator can provide valuable insights into market trends and price movements.

Its customizable settings also allow traders to adjust the indicator to suit their specific needs and preferences.

However, as with any technical analysis tool, it is important to use the Auto Fibonacci Fan Indicator MT4 in conjunction with other indicators and fundamental analysis to make informed trading decisions.

With careful use and attention to market conditions, this tool can be a valuable asset for traders looking to improve their performance in the markets.