Atm Rsi Zone Trade Mtf Indicator Mt4 Review

The ATM RSI Zone Trade MTF Indicator MT4 is a technical analysis tool used by traders to determine price trends in the forex market.

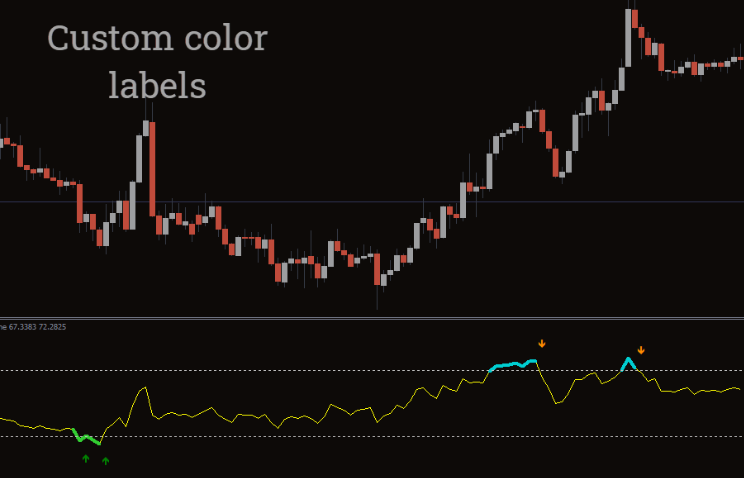

This indicator is based on the Relative Strength Index (RSI) and provides traders with a visual representation of overbought and oversold zones in the market.

The RSI is a momentum oscillator that measures the strength of recent price movements to determine whether an asset is overbought or oversold.

Download Free Atm Rsi Zone Trade Mtf Indicator Mt4

The ATM RSI Zone Trade MTF Indicator MT4 takes this concept further by displaying multiple timeframes on one chart, allowing for a more comprehensive analysis of market trends.

With this tool, traders can identify potential trading opportunities by looking for signals such as divergences between price and momentum indicators.

Understanding the ATM RSI Zone Trade MTF Indicator MT4

This section provides an in-depth understanding of a technical analysis tool designed for the MetaTrader 4 platform that assists traders in identifying potential buying and selling opportunities based on multiple time frames.

The ATM RSI Zone Trade MTF Indicator MT4 is a versatile indicator developed to provide traders with a comprehensive view of the market by analyzing different time frames simultaneously. This indicator can be used to identify trend direction, momentum, volatility, and overbought or oversold conditions across several time intervals.

The ATM RSI Zone Trade MTF Indicator MT4 is designed to work seamlessly with the MT4 platform, allowing traders to easily integrate it into their trading strategies. Unlike other indicators that focus solely on relative strength index (RSI) analysis, this tool combines various technical indicators such as moving averages and Bollinger bands to generate more accurate signals.

Traders who prefer alternative indicators for RSI analysis will find this tool useful as it offers a unique approach for identifying potential entry and exit points in the market based on multiple time frame analysis.

How to Use the ATM RSI Zone Trade MTF Indicator MT4

Identifying oversold and overbought conditions is a crucial step in using the ATM RSI Zone Trade MTF Indicator MT4. This indicator uses the Relative Strength Index (RSI) to determine whether a currency pair is oversold or overbought.

Analyzing trend direction is also important, as it helps traders to better predict future price movements and identify potential entry and exit points.

Identifying Oversold and Overbought Conditions

By understanding the levels at which a market is considered oversold or overbought, traders can make informed decisions about when to enter or exit trades, increasing their chances of success and minimizing losses.

One of the most popular RSI trading strategies involves identifying overbought and oversold conditions using technical analysis indicators such as the ATM RSI Zone Trade MTF indicator on MT4.

The ATM RSI Zone Trade MTF indicator on MT4 helps traders identify potential buying or selling opportunities by highlighting areas where the market may be experiencing overbought or oversold conditions.

When an asset is deemed to be overbought, it means that its price has increased significantly in a short period, leading to a potential reversal in trend.

Conversely, when an asset is said to be oversold, it suggests that its price has dropped too much too quickly, indicating a possible uptrend ahead.

By closely monitoring these signals through technical analysis indicators like the ATM RSI Zone Trade MTF Indicator MT4, traders can make more informed decisions about when to buy or sell assets while managing risk effectively.

Analyzing Trend Direction

To effectively analyze trend direction, traders can utilize a variety of technical analysis tools and methods to identify patterns and signals that suggest whether an asset’s price is trending upwards, downwards, or sideways.

One common tool used for trend analysis is the moving average indicator. This indicator calculates the average price of an asset over a specified period of time, such as 50 or 200 days, and plots it on a chart. By comparing current prices to the moving average line, traders can interpret whether the asset is in an uptrend (prices above the moving average), downtrend (prices below the moving average), or trading within a range (prices near the moving average).

Another tool for analyzing trend patterns is the Relative Strength Index (RSI) oscillator. The RSI measures momentum by tracking how much an asset’s price has moved up or down over time compared to its recent history. When RSI readings are high, it suggests that prices have risen too far too fast and may be due for a correction. Conversely, low RSI readings indicate that prices have fallen too far too quickly and may be oversold.

Traders can combine these tools with other technical indicators like support and resistance levels to gain further insights into market trends and potential trade opportunities using ATM RSI Zone Trade MTF Indicator MT4.

Identifying Entry and Exit Points

Traders must have a clear understanding of market trends and utilize technical analysis tools to identify optimal entry and exit points for trades. Effective timing strategies play a crucial role in maximizing profit potential, as traders aim to enter the market at an advantageous price point and exit before any significant trend reversal occurs.

To identify entry points, traders often use technical indicators such as the ATM RSI Zone Trade MTF indicator MT4, which helps track changes in momentum and identifies overbought or oversold conditions in the market. Additionally, traders may use chart patterns or candlestick formations to identify potential buy signals.

On the other hand, identifying exit points can be more challenging as it requires monitoring market conditions closely and making informed decisions based on risk management principles. Traders may consider using trailing stop-loss orders or profit targets to manage their positions efficiently.

Ultimately, finding the right balance between entry and exit strategies is key to achieving consistent profitability in trading.

Benefits of Using the ATM RSI Zone Trade MTF Indicator MT4

Using the ATM RSI Zone Trade MTF Indicator MT4 can significantly improve trading decisions by providing traders with a reliable tool to analyze market trends and potential entry and exit points.

Its multi-timeframe feature allows traders to have a more comprehensive view of the market, increasing their chances of success.

The indicator also saves time and effort in analysis as it automates certain processes, allowing traders to focus on other important aspects of their trading strategy.

Improving Trading Decisions

Enhancing one’s trading decisions requires a thorough understanding of the market trends and an ability to interpret complex data through objective analysis.

The ATM RSI Zone Trade MTF Indicator MT4 can aid traders in making informed decisions by providing insights into market volatility and risk management strategies.

It is designed to identify potential trend changes by analyzing multiple time frames, which allows traders to have a better understanding of the market conditions.

The indicator also provides real-time alerts when certain conditions are met, allowing traders to take immediate action.

Furthermore, it helps traders manage their risks by highlighting potential stop-loss levels and exit points.

This feature enables traders to minimize losses while maximizing profits, ultimately leading to more successful trades.

By utilizing these key features, the ATM RSI Zone Trade MTF Indicator MT4 can greatly enhance one’s trading decisions and overall profitability in the foreign exchange market.

Increasing Trading Success

One effective strategy for increasing trading success involves analyzing market trends and implementing risk management techniques to minimize losses and maximize profits.

Effective strategies in trading require a thorough understanding of the market and an ability to manage emotions, such as fear and greed, that can influence decision-making.

Traders must also be disciplined in their approach, sticking to a predetermined set of rules rather than making impulsive or emotional trades.

Trading psychology plays a crucial role in increasing trading success.

Traders who are able to control their emotions are better equipped to make rational decisions based on technical analysis and market trends rather than being swayed by short-term fluctuations or news events.

Additionally, traders who implement clear risk management techniques, such as stop-loss orders and position sizing, are more likely to minimize losses and protect against unexpected market movements.

By combining effective strategies with strong mental discipline, traders can increase their chances of success in the markets.

Saving Time and Effort in Analysis

Efficiently analyzing market trends and implementing time-saving techniques can increase a trader’s productivity and allow for more thorough analysis of multiple markets.

One way to optimize analysis is by using the ATM RSI Zone Trade MTF Indicator MT4. This indicator allows traders to view multiple timeframes on one chart, saving them the effort of switching between charts to analyze different timeframes. Additionally, it provides clear signals for entry and exit points based on RSI zones, making it easier for traders to make informed decisions.

Another way to save time in analysis is by utilizing automated trading systems that use algorithms to analyze market trends and execute trades based on predetermined criteria. These systems can be programmed with specific rules and parameters, allowing traders to focus on other aspects of their trading strategy while the system handles the technical analysis and execution of trades.

However, it is important for traders to thoroughly test these systems before implementing them in live trading as they may not always perform as expected in all market conditions.

Overall, incorporating efficient analysis techniques such as using indicators like ATM RSI Zone Trade MTF Indicator MT4 or automated trading systems can save traders valuable time and effort while increasing their chances of success in the markets.

Conclusion

The ATM RSI Zone Trade MTF Indicator MT4 is a technical analysis tool that can be used to identify overbought and oversold market conditions. By analyzing the Relative Strength Index (RSI) across multiple timeframes, traders can gain a more comprehensive understanding of market trends and make informed trading decisions.

Using the indicator requires an understanding of basic technical analysis principles and familiarity with the MetaTrader 4 platform. However, once mastered, it can provide valuable insights into market conditions.

The benefits of using the ATM RSI Zone Trade MTF Indicator MT4 include improved accuracy in identifying potential entry and exit points, enhanced risk management capabilities, and increased confidence in trading decisions.

Overall, the ATM RSI Zone Trade MTF Indicator MT4 is a powerful tool for traders looking to improve their technical analysis skills. While its use requires some experience in trading and familiarity with charting software, the benefits it offers are well worth the effort.

By incorporating this indicator into their trading strategies, traders can gain greater insight into market trends and make more informed decisions about when to enter or exit positions.