Asian Breakout Range Indicator For Mt4 Review

The Asian Breakout Range Indicator for MT4 is a tool that traders can use to identify potential breakouts during the Asian trading session. This indicator calculates the range of price fluctuations during the Asian session and marks these levels on the chart, allowing traders to determine potential entry and exit points.

The indicator is designed for use with the MetaTrader 4 (MT4) platform, which is widely used in forex trading. The purpose of this article is to provide an overview of the Asian Breakout Range Indicator for MT4, including its benefits, installation process, and tips for successful trading.

Download Free Asian Breakout Range Indicator For Mt4

By understanding how this indicator works and how it can be used in conjunction with other technical analysis tools, traders can improve their chances of making profitable trades during the Asian session.

What is the Asian Breakout Range Indicator for MT4?

The current section provides an explanation of a technical analysis tool used in the trading platform MT4 that is designed to identify potential market movements during a specific time period.

The Asian Breakout Range Indicator for MT4 aims to help traders identify profitable opportunities by highlighting levels at which price movements may occur during the Asian trading session.

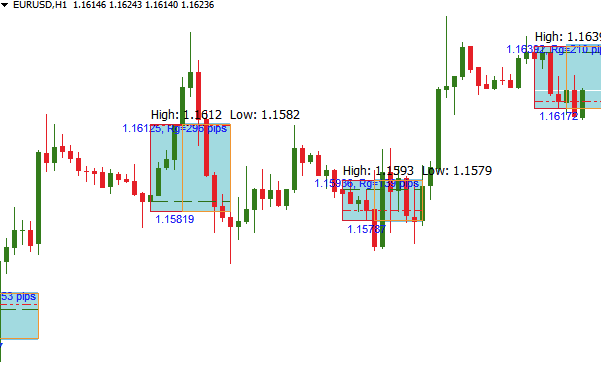

This indicator works by drawing two horizontal lines on the chart, representing the highest and lowest prices reached during the Asian session. To use this indicator, traders must first determine what constitutes the ‘Asian session’ for their chosen currency pair and then adjust the settings accordingly.

Once set up, traders can observe how price behaves around these levels, and if it breaks out above or below them, they can take advantage of potential trading opportunities. It is essential to note that while this indicator has been shown to perform well in certain market conditions, it is not foolproof, and alternative breakout strategies should also be considered when making trading decisions.

Benefits of Using the Indicator

This section highlights the advantages of incorporating the Asian Breakout Range Indicator for MT4 into one’s trading strategy. By using this tool, traders can potentially enhance their market analysis and increase profitability.

Here are some of the benefits that come with utilizing this indicator:

- Accurate Entry Signals: The Asian Breakout Range Indicator provides reliable signals for potential entry points in a trade. It helps traders identify significant price levels to initiate or exit positions, reducing the probability of making poor decisions.

- Simplified Market Analysis: With the help of this indicator, traders can quickly determine where to set stop-loss orders and take-profit levels based on support and resistance zones. This simplifies market analysis, allowing them to make better-informed decisions.

- Customizable Settings: One advantage of using an MT4 platform is its ability to customize indicators according to personal trading preferences. Traders can adjust settings such as timeframes and ranges in line with their individual strategies.

- Time-Efficient Trading: This tool is particularly useful for those who prefer short-term trading strategies as it focuses on the breakout period during specific times of day. This saves time spent analyzing charts outside these hours while still providing opportunities for profitable trades within these periods.

Overall, incorporating the Asian Breakout Range Indicator for MT4 can significantly improve one’s trading success by offering accurate signals, simplified market analysis, customizable settings, and efficient use of time.

How to Install and Use the Indicator

Installing and using the Asian Breakout Range Indicator for MT4 requires a step-by-step guide that is easy to follow.

The installation process involves downloading the indicator file and copying it into the MT4 program folder.

Setting entry and exit points require an understanding of how the indicator works, including its volatility range and breakout levels.

To maximize its potential, traders should experiment with different settings and use other technical indicators to confirm signals before entering trades.

Step-by-step guide on installation

The step-by-step guide presented below elucidates the process of installing the Asian Breakout Range indicator for MT4, providing a clear understanding of how to successfully incorporate it into one’s trading strategies. It is important to note that the installation process may vary depending on the version of MT4 being used. Additionally, customization settings are available for optimizing the indicator’s performance according to individual trading preferences.

To install the Asian Breakout Range indicator on MT4, follow these steps:

- Download and extract the .zip file containing the indicator.

- Open your MT4 platform and click ‘File’ > ‘Open Data Folder.’

- Navigate to ‘MQL4’ > ‘Indicators’ and move/copy the extracted files into this folder.

- Restart your platform or press F5 to refresh your indicators list.

- The Asian Breakout Range indicator should now appear in your Navigator window under ‘Custom Indicators.

In case of any issues during installation or use, troubleshooting tips can be found online through various forums or by contacting customer support from where you downloaded the indicator. Overall, incorporating this tool into one’s trading strategy can assist with identifying potential breakout opportunities in Asia market hours and provide valuable insights for decision making.

Setting entry and exit points

One key aspect of successful trading is determining optimal entry and exit points, which can be accomplished through careful analysis and utilization of available tools.

In the case of the Asian Breakout Range indicator for MT4, traders can use it to identify potential entry and exit positions by analyzing market volatility during the Asian session. To set entry points, traders can look for a breakout above or below the Asian range levels with confirmation from other technical indicators such as moving averages or oscillators. Stop loss orders can also be placed based on predetermined risk-reward ratios and support or resistance levels.

When setting exit points, traders can consider taking profits at key psychological levels or pivot points within the trend. Another option is to use trailing stop loss orders that adjust according to price movement in order to capture as much profit as possible while minimizing potential losses.

Overall, using this indicator in conjunction with sound trading principles such as risk management and disciplined execution can help improve trading performance and increase profitability over time.

Tips for maximizing its potential

Maximizing the potential of the Asian breakout range indicator for MT4 requires adhering to several tips that can enhance trading strategies and increase returns.

Firstly, traders must take advantage of backtesting results to optimize their entry and exit points. Backtesting involves testing a strategy using historical market data to determine its effectiveness. By analyzing past performance, traders can identify patterns and trends that they can use in future trades.

Secondly, common mistakes made by traders should be avoided when using the Asian breakout range indicator for MT4. One of the most common mistakes is overtrading, which involves opening too many positions at once or taking on excessive risks. Overtrading can lead to significant losses if the market moves against a trader’s position.

Another mistake is failing to set stop-loss orders, which are designed to limit losses if a trade goes against expectations. Traders who fail to set stop-loss orders risk losing more money than they intended and may find it difficult to recover from significant losses.

Overall, employing these tips while using the Asian breakout range indicator for MT4 enables traders to maximize its potential and achieve greater success in their trades.

Tips for Successful Trading with the Asian Breakout Range Indicator

Understanding market conditions is key when using the Asian Breakout Range Indicator for successful trading.

The indicator operates on the principle that markets tend to be quiet during the Asian trading session and then experience a breakout in price movement during the European or North American sessions.

Risk management and money management strategies are also crucial when using this indicator, as it can generate false signals during periods of low volatility.

Combining the use of other indicators or trading strategies can help confirm signals generated by the Asian Breakout Range Indicator and increase overall profitability.

Understanding market conditions

The section currently being discussed focuses on comprehending the market conditions, which is essential for making informed decisions while trading. Market analysis plays a crucial role in understanding these conditions and predicting future trends. It involves studying various factors such as economic indicators, political events, and social changes that can impact the market’s performance. Traders need to analyze both technical and fundamental data to identify potential opportunities and risks.

Technical analysis involves using charts, indicators, and other tools to study past price movements and patterns. Fundamental analysis, on the other hand, involves analyzing economic news releases, earnings reports, and other financial data to determine an asset’s intrinsic value.

Trading psychology also plays a significant role in understanding market conditions. Emotions such as fear and greed can cloud judgment and lead traders to make impulsive decisions that result in losses. Successful traders understand how their emotions affect their decision-making process and develop strategies to manage them effectively. They approach trading with discipline and patience while maintaining a long-term perspective rather than getting caught up in short-term fluctuations.

They also have a clear understanding of their risk tolerance levels and use appropriate money management techniques to minimize potential losses while maximizing profits. By taking into account both market analysis and trading psychology when assessing current market conditions, traders can make informed decisions that increase their chances of success.

Risk management and money management strategies

Traders who implement effective risk management and money management strategies are more likely to consistently achieve profitable results and avoid significant losses, thereby increasing their overall success in the market.

Position sizing techniques play a critical role in managing risk as they determine the size of a trader’s position based on their account balance, risk tolerance, and stop loss level. By using position sizing techniques such as fixed fractional or percentage-based position sizing, traders can minimize their exposure to any single trade, reducing the likelihood of experiencing large losses that could wipe out their trading account.

Evaluating risk reward ratios is another key aspect of risk management that traders need to master. This involves assessing the potential reward of a trade against its potential risks by comparing the profit target with the stop loss level. If a trade offers a low-risk ratio, it may not be worth taking as it does not offer sufficient rewards for the risks involved.

On the other hand, trades with high risk-reward ratios are more attractive as they offer better profit potential than what would be lost if stopped out. By using proper risk management principles like these along with appropriate money management techniques such as limiting maximum drawdowns or setting trailing stops, traders can increase their chances of achieving long-term profitability while minimizing losses over time.

Combining with other indicators or trading strategies

Incorporating risk management and money management techniques with other trading strategies or indicators can enhance a trader’s overall approach to the market, increasing their chances of achieving profitable results while minimizing potential losses.

When using the Asian Breakout Range Indicator for MT4, traders can combine it with other indicators or strategies to improve their decision-making process. One popular indicator that traders use in conjunction with the Asian Breakout Range Indicator is the Moving Average Convergence Divergence (MACD) indicator.

The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of prices. Combining this indicator with the Asian Breakout Range Indicator can help traders identify potential trends and confirm entry and exit points.

Additionally, traders may also incorporate Fibonacci retracement levels when using these two indicators together as they can indicate potential price levels where corrections may occur during a trend. Other trading strategies such as support and resistance levels or candlestick patterns may also be used in combination with these indicators to provide additional confirmation signals for trade entries and exits.

Conclusion

In conclusion, the Asian Breakout Range Indicator for MT4 is a useful tool for traders who want to capitalize on market movements during the Asian trading session. Its ability to identify key breakout levels and provide clear signals can help traders make informed decisions about when to enter or exit trades.

By installing and using this indicator in combination with other technical analysis tools and strategies, traders can increase their chances of success in the forex market. However, it is important to remember that no indicator or strategy can guarantee profits in trading.

It is always essential for traders to conduct thorough research, practice risk management techniques, and stay disciplined in their approach to trading. With patience and perseverance, traders can use the Asian Breakout Range Indicator as part of a comprehensive trading plan that helps them achieve their financial goals over time.