Ama Optimized Mt4 Indicator Review

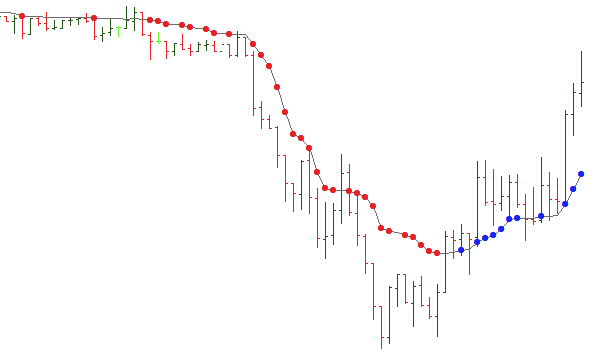

The AMA Optimized MT4 Indicator is a technical analysis tool used to identify trends in the financial markets. This indicator is designed to adjust its parameters according to market conditions, providing traders with accurate and reliable signals for making profitable trades. Download Free Ama Optimized Mt4 Indicator

The AMA Optimized MT4 Indicator is widely used by traders worldwide, especially those who prefer using the MetaTrader 4 platform. Installing and using the AMA Optimized MT4 Indicator requires basic knowledge of trading platforms, technical indicators, and charting tools.

Once installed on the MetaTrader 4 platform, this indicator can be customized based on individual preferences and trading strategies. The AMA Optimized MT4 Indicator uses a moving average algorithm that calculates the weighted average price of an asset over a specific period, adjusting its sensitivity to market volatility.

This feature enables traders to determine trend direction and potential entry/exit points accurately. Overall, the AMA Optimized MT4 Indicator is a valuable tool for traders looking to improve their trading performance by identifying profitable opportunities in the financial markets.

Download Free Ama Optimized Mt4 Indicator

The AMA Optimized MT4 Indicator is widely used by traders worldwide, especially those who prefer using the MetaTrader 4 platform. Installing and using the AMA Optimized MT4 Indicator requires basic knowledge of trading platforms, technical indicators, and charting tools.

Once installed on the MetaTrader 4 platform, this indicator can be customized based on individual preferences and trading strategies. The AMA Optimized MT4 Indicator uses a moving average algorithm that calculates the weighted average price of an asset over a specific period, adjusting its sensitivity to market volatility.

This feature enables traders to determine trend direction and potential entry/exit points accurately. Overall, the AMA Optimized MT4 Indicator is a valuable tool for traders looking to improve their trading performance by identifying profitable opportunities in the financial markets.

What is the AMA Optimized MT4 Indicator?

The present section introduces a technical analysis tool known as the AMA optimized MT4 indicator. This indicator is designed to assist traders in identifying trends in financial markets, thus providing them with useful insights into potential trading opportunities. The AMA optimized MT4 indicator is a versatile tool that can be utilized by traders across different time frames and market conditions. One of the key benefits of using the AMA optimized MT4 indicator in forex trading is its ability to filter out noise from price movements. This means that the indicator can identify long-term trends even when there are short-term fluctuations in prices. Additionally, the AMA optimized MT4 indicator provides traders with clear signals for entry and exit points, which helps to increase their chances of making profitable trades. Overall, this technical analysis tool is an essential asset for any trader looking to make informed decisions based on comprehensive market insights.How to Install and Use the Indicator

This section provides clear instructions on the installation and utilization of the AMA Optimized MT4 Indicator, enabling traders to enhance their technical analysis capabilities and make more informed investment decisions. To install this tool, traders need to first download the indicator file from a reliable source and save it in the correct folder in their MetaTrader 4 platform. The installation process is straightforward and can be completed within minutes by following simple instructions provided by most online resources. Once installed, traders can customize the indicator settings based on their preferences and trading strategies. Customization options include changing the color scheme, adjusting sensitivity levels, selecting timeframes, among others. By customizing these settings to suit individual trading styles, traders can improve accuracy and reduce errors when analyzing price movements using this tool. Overall, with proper installation and customization of the AMA Optimized MT4 Indicator, traders can gain valuable insights into market trends that help them make better-informed investment decisions.What are the Features of the Cam H4 Historical V4 Mt4 Indicator?

The cam h4 historical v4 mt4 indicator offers a range of powerful features for traders. With its historical data analysis, it allows users to examine past market trends and patterns. Its customizable settings provide flexibility, while the V4 version introduces enhancements, ensuring accurate and reliable signals. Traders can benefit from the clear visual representation and comprehensive analysis offered by this indicator.

How the Indicator Can Help Improve Trading Performance

This discussion focuses on how the AMA Optimized MT4 Indicator can help improve trading performance by identifying market trends, timing entry and exit points, and reducing emotional trading decisions. Identifying market trends is an essential aspect of successful trading, and this indicator provides a reliable way to do so. Additionally, timing entry and exit points accurately is crucial for maximizing profits while minimizing losses, which the indicator also helps achieve. Finally, reducing emotional trading decisions is important for maintaining rational decision-making processes amidst the volatility of financial markets; the AMA Optimized MT4 Indicator assists in this regard as well.Identifying market trends

An analysis of the financial market is conducted to identify prevailing trends through a systematic approach. Identifying market trends is crucial in developing effective trading strategies, as it allows traders to make informed decisions based on the direction of the market. Trend following strategies are commonly used by traders to capitalize on these trends and maximize profits. To identify market trends, traders can use various technical indicators such as moving averages, trend lines, and momentum indicators. These tools help traders visualize price movements over time and determine whether the market is trending upwards or downwards. Additionally, fundamental analysis can also be used to identify long-term trends based on economic factors such as interest rates, inflation rates, and geopolitical events. By combining both technical and fundamental analysis, traders can gain a comprehensive understanding of the current state of the market and develop effective trading strategies that align with prevailing trends.- Moving averages: A popular tool used by traders to identify trend direction.

- Trend lines: Used to connect two or more price points and provide insight into potential support or resistance levels.

- Momentum indicators: Help traders determine whether a trend is gaining or losing momentum.

- Fundamental analysis: Provides insight into long-term economic factors that may impact market trends.