All Time Frame Macd Window Indicator For Mt4 Review

The Moving Average Convergence Divergence (MACD) indicator is a popular technical analysis tool used by traders to identify potential trend reversals or momentum shifts in the market. It uses two moving averages, a faster and slower one, to generate signals when they intersect or diverge from each other.

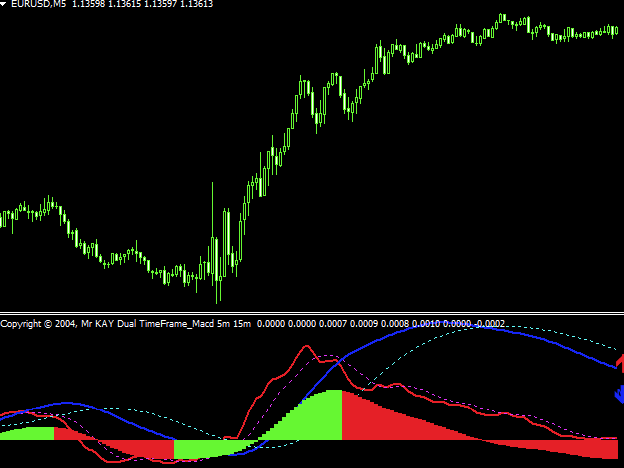

However, the standard MACD only displays data for one time frame, which can limit its effectiveness in analyzing price movements across different time frames. To address this issue, traders have developed the All Time Frame Macd Window Indicator for MT4, which allows them to view MACD data for multiple time frames simultaneously on one chart.

Download Free All Time Frame Macd Window Indicator For Mt4

This provides a more comprehensive view of market trends and helps traders make better-informed decisions based on the overall direction of the market. In this article, we will explore how this indicator works and its benefits for traders looking to improve their technical analysis skills.

Understanding the Moving Average Convergence Divergence (MACD) Indicator

The Moving Average Convergence Divergence (MACD) indicator is a commonly used technical analysis tool that measures the difference between two exponential moving averages to identify potential trend reversals and momentum shifts.

The MACD calculation involves subtracting the 26-period exponential moving average (EMA) from the 12-period EMA, with a signal line of a nine-period EMA plotted on top of the MACD line.

The result is depicted as a histogram, which oscillates above and below the zero line, indicating whether prices are bullish or bearish.

Interpreting the MACD histogram involves observing its crossovers with the signal line and zero lines.

When it crosses above the signal line or zero lines, it signifies bullish momentum in price trends, while crossing below signals bearish momentum.

Traders may also use divergences between price action and MACD readings to identify potential trend reversals.

Overall, traders use MACD as an effective tool for identifying trend direction and spotting key entry/exit points in trades by analyzing its histogram movements alongside other technical indicators.

Benefits of the All Time Frame Macd Window Indicator for MT4

This analytical tool provides a panoramic view of the market’s momentum by seamlessly integrating data from multiple time periods.

The All Time Frame MACD Window Indicator for MT4 offers traders an advantage in identifying trends and differentiating signals by comparing results across different time frames.

This indicator can be applied to any asset class such as stocks, commodities, or forex pairs.

One of the main benefits of this indicator is the ability to analyze price movements at various intervals.

Traders can examine short-term movements while also considering longer-term trends to gain insight into potential price direction changes.

By examining several time frames simultaneously, traders can avoid making trades based on ambiguous signals that may only be evident in one specific timeframe.

Overall, incorporating this powerful technical tool assists traders in making better-informed decisions in real-time trading situations and improves their overall profitability.

How to Use the All Time Frame Macd Window Indicator for MT4

Installing the All Time Frame Macd Window Indicator for MT4 involves downloading the indicator file and copying it into the ‘Indicators’ folder of your MetaTrader 4 platform.

Once installed, users can utilize the indicator to identify signals across multiple time frames by observing changes in trend direction and strength.

For more comprehensive analysis, traders may also incorporate additional technical indicators such as moving averages or Fibonacci retracements.

Installing the Indicator on Your Trading Platform

To effectively incorporate the all time frame MACD window indicator into your trading strategy, it is essential to follow the proper steps for installation on your preferred trading platform.

The first step in installing the indicator is to download the file from a reputable source and save it to a location on your computer that you can easily access. Once you have downloaded the file, open your MT4 trading platform and click on ‘File’ at the top left corner of the screen.

From there, select ‘Open Data Folder,’ which will take you to a directory where you can find the ‘MQL4’ folder. Within this folder, look for ‘Indicators’ and copy or move the downloaded file into this folder.

After completing these initial steps, you must configure your indicator settings before using it in live trading. To do so, navigate back to MT4 and open a chart where you would like to use the all time frame MACD window indicator.

Click on ‘Insert’ at the top menu bar and select ‘Indicators.’ From here, locate and select the all time frame MACD window indicator from within your list of indicators. This should launch an options menu where you can customize various settings such as color schemes, signal line periods, and more depending on how you want to use this tool in conjunction with other technical analysis methods.

Finally, if any issues arise during installation or configuration of this indicator, be sure to consult online forums or reach out to customer support for assistance troubleshooting common problems that traders face when setting up new tools within their software suite.

Identifying Signals Across Multiple Time Frames

An effective trading strategy involves identifying signals across multiple time frames using customized settings on the all time frame MACD window indicator, which can be easily accessed and configured within your preferred trading platform.

Multi timeframe analysis techniques allow traders to view trends and patterns in different time frames, providing a more comprehensive understanding of market movements. The all time frame MACD window indicator is particularly useful for this purpose, as it allows traders to visualize MACD signals across various timeframes simultaneously.

When comparing other multi timeframe indicators with the all time frame MACD window indicator for MT4, it is important to consider their unique features and capabilities. While some indicators may provide more detailed information on specific aspects of market movements, such as price action or volatility, the all time frame MACD window indicator offers a comprehensive overview of trend strength and momentum across multiple time frames.

By utilizing this tool alongside other technical analysis methods and risk management strategies, traders can increase their chances of making informed decisions and achieving successful trades.

Incorporating Other Technical Indicators for Better Analysis

Combining MACD with Fibonacci retracements and using RSI to confirm MACD signals can enhance the accuracy of signal identification across multiple time frames. This is particularly useful for traders who use the all-time-frame MACD window indicator for MT4, as it allows them to analyze price movements and trends over different periods.

To incorporate other technical indicators for better analysis, traders can follow these steps:

- Use Fibonacci retracements to identify key levels of support and resistance, which can help in determining potential entry and exit points.

- Look for confluence between the MACD signals and Fibonacci levels, such as a bullish crossover occurring near a strong level of support.

- Use RSI to confirm the strength of the trend indicated by the MACD. If both indicators show a strong uptrend or downtrend, it increases the likelihood that the signal is accurate.

- Consider using other technical indicators such as moving averages or Bollinger Bands in conjunction with MACD to further refine analysis.

By incorporating these additional indicators into their analysis, traders can increase their confidence in identifying profitable trades across multiple time frames using the all-time-frame MACD window indicator for MT4.

Conclusion

In conclusion, the Moving Average Convergence Divergence (MACD) indicator is a widely used tool in technical analysis to identify trend strength and potential changes in direction.

The All Time Frame Macd Window Indicator for MT4 takes this useful tool a step further by allowing traders to view MACD signals across multiple time frames simultaneously on one chart.

This provides a more comprehensive view of market trends and can aid in making informed trading decisions.

Using the All Time Frame Macd Window Indicator for MT4 requires an understanding of basic MACD principles and some experience with technical analysis.

With proper use, however, this indicator can be a valuable addition to any trader’s toolbox.

By providing a clearer picture of market trends across multiple time frames, it can help traders stay ahead of the curve and make better-informed trades based on reliable data.