All Divergence Indicator Mt4 Review

The All Divergence Indicator MT4 is a technical analysis tool used by traders to identify divergences between price and momentum indicators. Divergence occurs when the price of an asset moves in a different direction than its corresponding oscillator or momentum indicator. This can be a strong indication of a potential trend reversal, making it a popular tool among forex traders.

The All Divergence Indicator MT4 is designed to scan multiple time frames and chart types, providing traders with an accurate and reliable signal of divergence. The indicator can be customized to suit individual trading strategies, allowing for greater flexibility in identifying profitable trade opportunities.

Download Free All Divergence Indicator Mt4

In this article, we will discuss how the All Divergence Indicator MT4 works, its benefits for traders, and how it can be incorporated into your trading strategy.

How the All Divergence Indicator MT4 Works

The functioning of the All Divergence Indicator MT4 is based on the technical analysis with divergence.

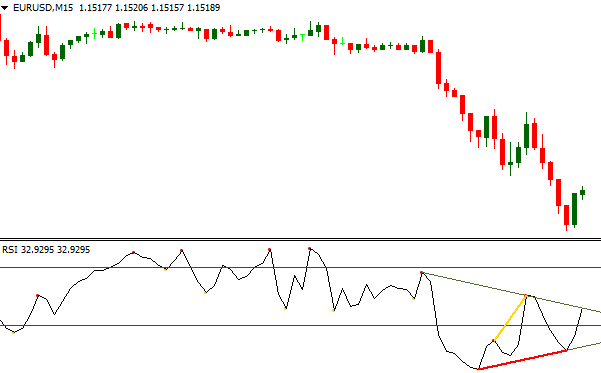

The indicator identifies divergences between price and an oscillator, such as RSI or MACD, which can signal a potential trend reversal or continuation.

A bullish divergence occurs when the price makes a lower low while the oscillator makes a higher low, indicating that momentum is shifting to the upside.

A bearish divergence occurs when the price makes a higher high while the oscillator makes a lower high, indicating that momentum is weakening and a downtrend may be imminent.

By identifying market trends with divergence, traders can gain insights into potential trading opportunities and make informed decisions about entering or exiting positions.

The All Divergence Indicator MT4 provides visual signals on charts for easy identification of divergences and includes customizable options for adjusting settings to fit individual trading strategies.

Overall, this tool can enhance technical analysis efforts and help traders better navigate ever-changing market conditions.

Benefits of Using the All Divergence Indicator MT4

This section highlights the advantages of utilizing a comprehensive tool that can detect variations in market trends and assist traders in making informed decisions. The All Divergence Indicator MT4 is an invaluable tool for technical analysis applications as it allows traders to spot divergence patterns and signals for potential price reversals.

Here are several benefits of using the All Divergence Indicator MT4:

- Provides early warning signals: The All Divergence Indicator MT4 is designed to identify divergences between price action and technical indicators, which often precede trend reversals. By detecting these early warning signals, traders can take advantage of potential market movements before they occur.

- Helps confirm trading strategies: The indicator’s ability to recognize divergence patterns helps traders confirm their strategies and make informed trading decisions with greater confidence.

- Facilitates pattern recognition: With its robust scanning capabilities, the All Divergence Indicator MT4 makes it easier for traders to analyze complex markets, spot hidden trends, and identify emerging patterns.

In summary, the All Divergence Indicator MT4 provides many trading advantages through its ability to detect early warning signals, help confirm trading strategies, and facilitate pattern recognition. By incorporating this powerful tool into their technical analysis arsenal, traders can gain a competitive edge in today’s dynamic financial markets.

How to Use the All Divergence Indicator MT4 in Your Trading Strategy

Setting up the All Divergence Indicator MT4 requires downloading and installing it onto your trading software platform.

Interpreting the results involves analyzing divergences between price and technical indicators, such as moving averages or oscillators, to identify potential trend reversals or continuations.

Incorporating the indicator into your trading plan can aid in making informed decisions about entering or exiting trades based on divergence signals.

Setting Up the Indicator

To properly utilize the All Divergence Indicator MT4, it is necessary to follow a step-by-step process that involves configuring the parameters of the tool and selecting the appropriate time frame for analysis.

The first step in setting up this indicator is to customize its settings according to one’s preferences. This can be done by clicking on the ‘Customize’ button located on the top right corner of the chart window. From there, traders can adjust various options such as color schemes, line styles, and signal alerts.

After customizing settings, it is essential to select an appropriate time frame for analysis. This is because divergence signals may vary depending on different periods of price movement. For instance, a bullish divergence may appear much stronger on a higher time frame than on a lower one.

To change time frames, traders must simply click on the corresponding tab located at the bottom of their chart window or use keyboard shortcuts such as ‘CTRL+T’.

As with any technical indicator, it is important to note that troubleshooting common issues such as lagging or inaccurate signals may require additional research or adjustments to one’s trading strategy.

Interpreting the Results

Understanding the significance of divergence signals and their implications for trading decisions is crucial when interpreting the results of this technical analysis tool.

One common mistake when interpreting divergence indicators is relying solely on them to make trading decisions without considering other factors such as market trends, support and resistance levels, and fundamental analysis.

Divergence indicators can provide useful information about potential trend reversals or continuation, but they should be used in conjunction with other tools. Additionally, traders should be cautious when interpreting divergences in volatile markets or during news events as these can affect price movements.

Advanced divergence trading strategies involve using multiple timeframes and different types of divergences to confirm signals.

For example, traders may look for bullish divergence on both the daily and hourly chart to increase confidence in a potential long position. Another strategy involves using oscillators such as the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) along with divergence indicators to identify entry and exit points.

It is important for traders to thoroughly backtest any advanced strategies before implementing them in live trading to ensure they are effective in different market conditions.

Overall, understanding how to interpret divergence signals correctly can improve trading performance and lead to more profitable trades.

Incorporating the Indicator into Your Trading Plan

Incorporating a technical analysis tool such as divergence signals into a trading plan requires careful consideration of market trends, support and resistance levels, and fundamental analysis in order to make informed trading decisions.

However, it is also important to consider the role of trading psychology when using the all divergence indicator MT4. Traders must be disciplined in their approach to interpreting the signals and avoid making impulsive trades based solely on the indicator’s results. It is essential for traders to have a clear understanding of their risk tolerance level so they can set appropriate stop-loss orders and exit strategies.

Combining multiple indicators with the all divergence indicator MT4 may also enhance its effectiveness in identifying potential entry and exit points. For example, traders may use other technical analysis tools such as moving averages or trendlines alongside the divergence signals to confirm their findings.

Additionally, incorporating fundamental analysis into one’s trading plan can provide insight into market conditions that may impact price movements, which can help traders make more informed decisions when using the all divergence indicator MT4.

Ultimately, incorporating this powerful technical analysis tool into one’s overall strategy requires a disciplined approach that involves careful consideration of market trends, support and resistance levels, fundamental analysis, and one’s own psychological biases towards risk-taking.

Conclusion

In conclusion, the All Divergence Indicator MT4 is a powerful tool for traders looking to identify potential trend reversals and trade entry/exit points. Its versatility allows it to be used across multiple asset classes and timeframes, providing valuable insights into market movements.

The indicator works by analyzing price action and identifying divergences between price movement and technical indicators such as MACD or RSI. This information can then be used to make informed trading decisions.

Using the All Divergence Indicator MT4 in your trading strategy can provide several benefits, including increased accuracy in identifying trend reversals and better timing of trade entries/exits. However, it is important to note that no indicator or tool can guarantee profits or eliminate risk entirely. It is crucial for traders to conduct proper analysis and risk management before making any trades based on indicator signals.

Overall, the All Divergence Indicator MT4 can be a valuable addition to any trader’s toolbox when used appropriately alongside other technical analysis tools.