Adx Vma Histogram Indicator For Mt4 Review

Technical analysis is a crucial aspect of trading in the financial markets. It involves using various indicators and tools to predict future price movements based on past market data. One such indicator that traders use is the ADX VMA Histogram Indicator for MT4.

This article aims to provide an analytical overview of this tool, its features, and how it can be used effectively. The ADX VMA Histogram Indicator for MT4 combines two popular indicators: Average Directional Index (ADX) and Volume Moving Average (VMA).

Download Free Adx Vma Histogram Indicator For Mt4

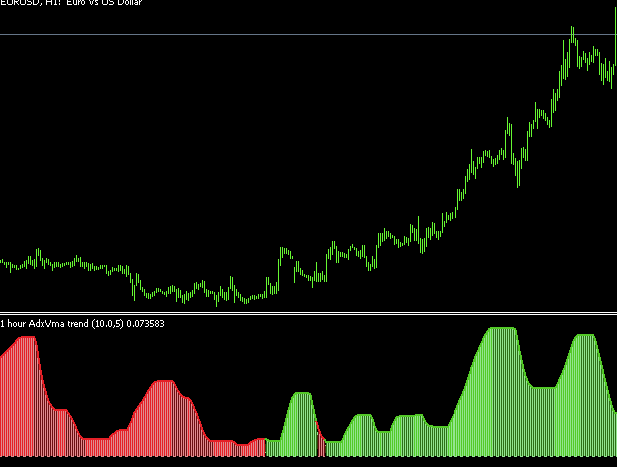

The ADX measures the strength of a trend, while VMA calculates the moving average of volume over a specified period. The histogram displays the difference between these two indicators, providing traders with a visual representation of trend strength combined with volume activity.

By using this indicator, traders can identify significant trends and potential areas where prices may reverse or continue to move in a particular direction.

Understanding the ADX VMA Histogram Indicator

The present section delves into the analysis of a technical tool utilized in financial trading, which is designed to capture the strength and trend of price movements over time.

The ADX VMA Histogram Indicator is a popular technical indicator used to measure the strength of a trend and identify potential reversals. It combines two indicators – Average Directional Index (ADX) and Volume Moving Average (VMA) – to create a histogram that can reveal information about market trends.

The calculating formula for the ADX VMA Histogram Indicator involves several steps. First, the ADX is calculated using price data from multiple periods. Then, the VMA is calculated by taking an average of volume data over time. Finally, these two values are combined to create a histogram that displays changes in trend strength over time.

Historical performance shows that this indicator has been effective in identifying strong trends and potential reversals in various financial markets such as Forex and stocks, making it a valuable tool for traders looking to make informed decisions based on market trends.

Using the ADX VMA Histogram Indicator in Your Trading Strategy

By incorporating the ADX VMA Histogram into their trading strategy, traders can potentially improve their decision-making process and increase their chances of success in the financial markets.

This indicator combines two popular technical analysis tools: Average Directional Index (ADX) and Volume Moving Average (VMA).

The ADX measures the strength of a trend, while the VMA tracks changes in volume over time. Together, they provide insight into market conditions that can help traders identify potential entry and exit points.

Backtesting results have shown that the ADX VMA Histogram is effective in identifying trends and predicting price movements. However, it is important to note that no indicator or trading strategy is foolproof.

Traders should always consider other factors such as fundamental analysis, news events, and market sentiment before making any trades. Additionally, it is recommended to practice using this indicator on a demo account before implementing it into real-world trades to gain familiarity with its nuances.

Overall, incorporating the ADX VMA Histogram into your trading strategy can be a valuable tool when used alongside other technical indicators and analysis methods.

Customizing the ADX VMA Histogram Indicator

Modifying and adapting technical analysis tools to suit individual trading styles can be a crucial step towards improving decision-making processes, and customization of the ADX VMA Histogram can provide traders with a more tailored approach to identifying potential entry and exit points.

One way to customize the indicator is by changing colors to reflect personal preferences or chart backgrounds. This can be done in the ‘Colors’ tab of the indicator’s properties window, where each component of the histogram (positive, negative, and signal) can be assigned different hues. Traders may also adjust periods to fine-tune the sensitivity of the indicator based on their preferred timeframes. The default values for ADX (14) and VMA (20) may not always be suitable for all trading strategies, so experimentation with different settings could help identify optimal parameters.

Another method for customizing the ADX VMA Histogram is through altering its calculation methods. By default, this indicator uses Wilder’s smoothing method for calculating Average Directional Index (ADX), but traders may opt for other techniques such as Simple Moving Average or Exponential Moving Average instead. Similarly, Variable Moving Average (VMA) can be replaced with other moving averages like Weighted Moving Average or Hull Moving Average if desired.

Changing these calculation methods may affect how sensitive or accurate signals generated by the ADX VMA Histogram are perceived by traders, so it is important to backtest any modifications before implementing them in live trading conditions.

Tips for Using the ADX VMA Histogram Indicator Effectively

Effective use of the ADX VMA Histogram requires careful consideration of various factors, including customization of periods, calculation methods, and color schemes, as well as backtesting modifications to ensure optimal performance.

One common mistake when using this indicator is relying solely on default settings without taking into account the specific market conditions or trading strategy. It is essential to adjust the period length and calculation method based on the desired timeframe and volatility levels. For instance, a shorter period may be more suitable for intraday trading, while a longer period may provide better signals in trending markets.

Moreover, advanced techniques such as adding different moving averages or combining multiple indicators can enhance the accuracy of signals generated by the ADX VMA histogram. For example, a trader could add an exponential moving average (EMA) alongside the ADX VMA histogram to confirm trend direction or use other oscillators like MACD or RSI to identify oversold/overbought levels.

Additionally, traders should pay attention to color schemes since they can affect visibility and ease of interpretation. Using contrasting colors between bullish/bearish signals or highlighting crossovers with bold lines can help reduce confusion and improve clarity when analyzing charts.

Conclusion

The ADX VMA Histogram Indicator is an advanced technical analysis tool that combines two popular indicators, the Average Directional Movement Index (ADX) and the Volume Moving Average (VMA). This indicator helps traders identify market trends by analyzing price movements and volume data.

The ADX VMA Histogram Indicator is highly customizable, allowing traders to adjust the parameters based on their specific trading strategies. Using this indicator in your trading strategy can help you make better-informed decisions by providing valuable insights into market trends and momentum.

You can use it to identify potential entry and exit points, as well as to manage your risk by setting stop-loss orders. It’s important to note that no single indicator can guarantee success in trading, but using the ADX VMA Histogram Indicator as part of a comprehensive trading plan can improve your overall profitability.

In conclusion, the ADX VMA Histogram Indicator is a powerful tool for technical analysis that provides valuable insights into market trends and momentum. By combining the ADX and VMA indicators, traders can gain a deeper understanding of price movements and volume data, which can help them make more informed decisions when trading financial instruments.

Whether you’re a beginner or an experienced trader, incorporating this indicator into your trading strategy can enhance your profitability and improve your overall success in the markets.