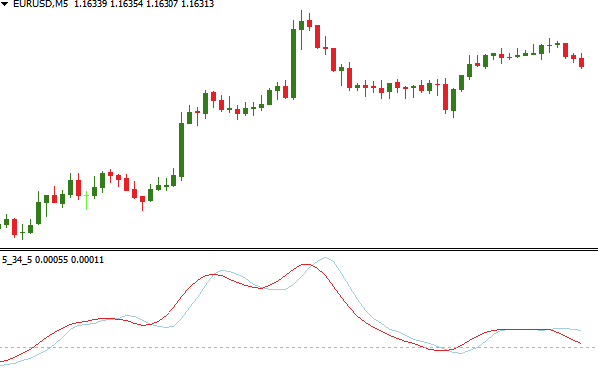

5-34-5 Oscillator For Mt4 Review

The 5-34-5 oscillator is a technical analysis tool used by traders to identify potential trading opportunities in the financial markets. It is designed to indicate both short-term and long-term trends, allowing traders to make informed decisions based on market conditions.

The oscillator provides valuable insights into market trends and can be used with various trading strategies to maximize profits. Developed for use on the MetaTrader 4 (MT4) platform, the 5-34-5 oscillator uses a simple moving average (SMA) crossover strategy to generate buy and sell signals.

Download Free 5-34-5 Oscillator For Mt4

The SMA is calculated by adding up prices over a specific period and dividing them by that period’s number of bars. By comparing two SMAs of different periods, traders can determine the trend direction of an asset. The 5-34-5 oscillator uses three SMAs: a short-term SMA of five bars, a medium-term SMA of 34 bars, and a long-term SMA of five bars.

By plotting these SMAs on a chart, traders can see when they cross over each other, indicating changes in trend direction.

Understanding the 5-34-5 Oscillator

The 5-34-5 oscillator is a popular technical analysis tool that helps traders identify trends in financial markets. This oscillator is calculated by finding the difference between two exponential moving averages (EMAs). The first EMA uses a period of 5, while the second EMA uses a period of 34. These values are based on Fibonacci numbers, which have been found to be effective in identifying market trends.

To understand how the 5-34-5 oscillator works, it’s important to have some background information on EMAs. An EMA is a type of moving average that gives more weight to recent price data than older price data. This means that EMAs respond more quickly to changes in market conditions than simple moving averages (SMAs), which give equal weight to all price data over a specified time period.

In other words, EMAs are better suited for identifying short-term trends, while SMAs are better for long-term trends. Once you understand this concept, calculating the 5-34-5 oscillator becomes relatively straightforward: simply subtract the value of the second EMA (using a period of 34) from the value of the first EMA (using a period of 5). The resulting difference will oscillate above and below zero depending on whether prices are trending up or down.

Using the 5-34-5 Oscillator for Trading

Using the 5-34-5 oscillator for trading requires understanding how to generate buy and sell signals based on its readings.

Traders must also be able to identify overbought and oversold conditions in order to make informed decisions about entering or exiting trades.

Setting stop losses and take profits is another essential aspect of successfully using this oscillator, as it helps manage risk and protect profits.

Generating Buy and Sell Signals

This section provides insight into the process of generating buy and sell signals through an analytical approach, highlighting key indicators that inform traders on market trends and potential trading opportunities.

To generate buy signals, traders should look for when the oscillator line crosses above the signal line, indicating a potential upward trend in prices. Conversely, sell signals are generated when the oscillator line crosses below the signal line, suggesting a possible downward trend in prices.

Fine tuning oscillator parameters is also crucial in generating accurate buy and sell signals. Traders can adjust parameters such as the periods used for calculation to optimize their trading strategy based on their preferred time frame or market conditions.

Additionally, backtesting the 5-34-5 oscillator performance allows traders to evaluate its effectiveness over historical data before using it in live trading. By analyzing past price movements and comparing them with the results of simulated trades using different buy/sell scenarios, traders can identify any weaknesses or strengths of their chosen oscillator model and make necessary adjustments to improve its accuracy.

Identifying Overbought and Oversold Conditions

Identifying overbought and oversold conditions is an important aspect of technical analysis that involves using key indicators to determine market trends and potential trading opportunities.

One commonly used indicator for this purpose is the Relative Strength Index (RSI). The RSI measures the strength of a security’s price action by comparing its average gains to its average losses over a specified period, typically 14 days.

A reading above 70 indicates that the security may be overbought, while a reading below 30 suggests that it may be oversold. Interpretation of divergences in RSI can also provide valuable insights into market conditions.

A bullish divergence occurs when the RSI makes a higher low while prices make a lower low, indicating underlying buying pressure despite falling prices. Conversely, a bearish divergence occurs when the RSI makes a lower high while prices make a higher high, suggesting underlying selling pressure despite rising prices.

Overall, identifying overbought and oversold conditions through technical analysis can be useful in determining potential entry and exit points for trades in various market conditions.

Setting Stop Losses and Take Profits

Establishing effective stop-loss and take-profit orders is an essential part of risk management in trading that can help traders minimize losses and lock-in profits at predetermined levels.

Calculating profits and losses accurately is crucial to determining appropriate levels for stop loss and take profit orders. Stop loss orders are placed below the current market price to limit potential losses, while take profit orders are placed above the current market price to lock in gains.

To adjust stop loss levels, traders must consider various factors such as market volatility, support and resistance levels, and overall risk tolerance. A tighter stop loss may be appropriate during periods of high volatility or when trading a more volatile asset, whereas a wider stop loss may be used for less volatile assets.

Take profit levels can also be adjusted based on market conditions or specific trading strategies. By setting appropriate stop-loss and take-profit orders, traders can effectively manage their risk exposure while maximizing their potential profits.

Tips for Improving Your Trading Strategies with the 5-34-5 Oscillator

Combining the 5-34-5 oscillator with other indicators can enhance trading strategies.

For instance, combining it with moving averages or trend lines can help identify key support and resistance levels, which can be used for entry and exit points.

Setting realistic targets is also crucial for success in trading as it helps to manage expectations and reduce emotional reactions to market movements.

Additionally, practicing risk management by setting stop-loss orders and using proper position sizing can help mitigate losses and preserve capital over the long run.

Combining with Other Indicators

The integration of additional technical indicators with the oscillator in MetaTrader 4 can provide traders with a more comprehensive and nuanced analysis of market trends.

Combining the oscillator with trend lines, for instance, can help traders identify key levels of support and resistance in the market. By plotting trend lines on price charts and using the oscillator to measure momentum, traders can potentially spot potential reversal points or continuation patterns.

Using the oscillator with candlestick patterns is another effective way to enhance trading strategies. For instance, combining the oscillator with bullish reversal candlestick patterns such as hammer or morning star formation could signal a buy entry point, while bearish reversal candlestick patterns like shooting star or evening star formation could indicate a sell entry point.

This combination of technical tools allows traders to gain additional insight into market conditions and improve their chances of making profitable trades.

Setting Realistic Targets

Achieving consistent profitability in trading requires setting realistic targets that take into account market conditions, risk management, and individual trading strategies.

It is important to avoid greediness when setting targets as it can lead to overtrading and unnecessary risks.

Traders should set achievable goals based on their analysis of the market data, technical indicators, and fundamental factors. By doing so, they can reduce their exposure to losses and increase their chances of profiting from successful trades.

Another crucial factor in setting realistic targets is adapting to market conditions. The markets are constantly changing and evolving, which means traders must be flexible in adjusting their expectations accordingly.

Strategies that may have worked well in the past may not perform the same way under different circumstances. Therefore, traders should regularly review and adjust their targets based on changes in volatility levels, news events, economic data releases, and other relevant factors impacting the markets.

Ultimately, by setting realistic targets and adapting to changing market conditions, traders can increase their chances of achieving long-term profitability while minimizing risks along the way.

Practicing Risk Management

Practicing effective risk management is a crucial aspect of successful trading, as it involves identifying and managing potential risks through the use of tools such as stop-loss orders, position sizing, and diversification.

One important tool for managing risk is calculating position size. This involves determining the amount of capital to allocate to each trade based on factors such as account balance, risk tolerance, and market volatility. By using this approach, traders can limit their exposure to any single trade and avoid large losses that could wipe out their entire portfolio.

Another important aspect of practicing effective risk management is backtesting strategies. This involves testing a trading strategy on historical data to evaluate its performance before applying it in live trading. Backtesting allows traders to identify strengths and weaknesses in their strategies and make necessary adjustments before risking real money in the markets.

Additionally, backtesting can help traders gain confidence in their strategies by providing evidence of their effectiveness over time. By incorporating these practices into their trading routine, traders can significantly improve their chances of success while minimizing potential losses.

Conclusion

In conclusion, the 5-34-5 oscillator is a technical indicator that is widely used by traders to identify potential trends in the market.

By analyzing the difference between two moving averages, this oscillator can provide insight into whether a currency pair is overbought or oversold.

Additionally, it can help traders determine when to enter or exit a trade.

However, like any trading strategy, it’s important to use the 5-34-5 oscillator in conjunction with other indicators and analysis tools to make informed decisions.

With practice and diligence, incorporating this oscillator into your trading strategies may assist you in making more effective trades.