123 Patterns V7 Indicator For Mt4 Review

Technical analysis is an essential tool for traders who wish to make informed decisions in the financial markets. The 123 Patterns V7 Indicator is a popular technical analysis tool used by traders to identify potential trend reversals and breakout opportunities. This indicator is designed specifically for MetaTrader 4 (MT4), which is one of the most widely used trading platforms in the world.

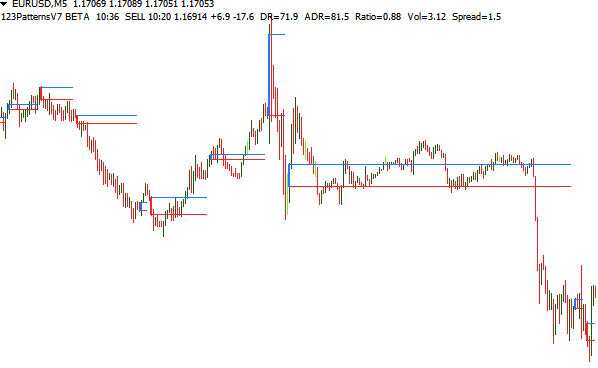

The 123 Patterns V7 Indicator works by identifying three points on a price chart that conform to specific criteria. These points are referred to as point 1, point 2, and point 3, and they represent potential reversal levels or breakout points.

Download free 123 Patterns V7 Indicator For Mt4

Traders can use this information to enter or exit trades at opportune moments, maximizing their profits while minimizing their risks. In this article, we will explore the features of the 123 Patterns V7 Indicator and provide tips for using it effectively in your trading strategy.

Understanding the 123 Patterns V7 Indicator

The section at hand pertains to comprehending the seventh version of the 123 Patterns, a technical analysis tool utilized in financial markets. The 123 Patterns V7 indicator is designed to identify patterns on charts that indicate possible price movements in the future.

As its name suggests, it identifies three specific points in the chart, namely point 1 (the highest or lowest point of an upward or downward trend), point 2 (the retracement from point 1), and point 3 (a higher high or lower low than point 1). When these three points appear on a chart, it signals that a new trend may be forming.

One key feature of the 123 Patterns V7 indicator is its ability to customize settings according to individual trader preferences. Traders can adjust the sensitivity of the indicator by changing certain parameters such as minimum and maximum bar lengths, as well as minimum and maximum retracements. This allows traders to fine-tune their strategies based on their risk tolerance levels and trading styles.

Additionally, backtesting strategies with historical data can help traders evaluate how effective their customized settings are before applying them in real-time trading situations.

Using the Indicator in Your Trading Strategy

Timing your entries and exits, identifying trends, and setting stop loss and take profit levels are essential components of any successful trading strategy.

Using the patterns v7 indicator for MT4 can assist in these areas by providing clear visual signals for potential trade opportunities and market trends.

By incorporating this tool into a trading plan, traders can make more informed decisions based on objective data rather than relying solely on subjective analysis.

Timing Your Entries and Exits

By strategically planning the timing of one’s trades, traders can increase their chances of profit by carefully selecting optimal entry and exit points. The Patterns v7 indicator for MT4 can help traders in this regard by providing valuable insight into potential trend reversals or continuations. However, simply relying on the indicator without considering other factors such as market conditions and news events can lead to false signals and poor trade execution.

To ensure entry precision when using the Patterns v7 indicator for MT4, traders should consider the following:

- Waiting for confirmation from other technical indicators

- Looking for specific chart patterns to align with the signal

- Considering current market conditions and news events

- Setting a stop loss to limit potential losses

Additionally, having an exit strategy is crucial in ensuring profitable trades. Traders should consider taking profits at predetermined levels or using trailing stops to capture maximum gains. It is also important to monitor the trade closely and adjust the exit strategy if necessary based on changing market conditions.

By combining entry precision with a solid exit strategy, traders can maximize their profitability when using the Patterns v7 indicator for MT4.

Identifying Trends

Accurately identifying trends is a crucial aspect of successful trading, as it allows traders to make informed decisions and capitalize on market movements. One way to identify trends is by using technical indicators such as the Patterns v7 indicator for MT4. This indicator uses various price patterns to identify potential trend reversals or continuations. It helps traders interpret signals and identify entry and exit points based on these patterns.

The table below shows some commonly used price patterns that the Patterns v7 indicator for MT4 can identify:

| Pattern | Description |

|---|---|

| Head and Shoulders | A bearish pattern that indicates a potential trend reversal |

| Double Top/Bottom | A bullish pattern (double bottom) or bearish pattern (double top) that indicates a potential trend reversal |

| Triangle | A continuation pattern that indicates a potential continuation of the current trend |

| Wedge | A continuation pattern similar to the triangle but with converging support and resistance levels |

By analyzing these patterns, traders can gain insight into market sentiment and make more informed trading decisions. However, it’s important to remember that no indicator is perfect, and market conditions can change quickly. Therefore, traders should always use multiple indicators in conjunction with their own analysis before making any trades.

Setting Stop Loss and Take Profit Levels

Establishing appropriate levels for stop loss and take profit is a vital step in risk management that allows traders to safeguard their capital and secure profits by setting predetermined limits on losses and gains.

Stop loss is an order to sell a security when it reaches a certain price level, while take profit is an order to close out a position at a specific profit level. These levels should be determined based on the trader’s risk management strategy, position sizing, and market conditions.

Traders should always set their stop loss levels before entering a trade to avoid emotional decisions during the trade. Stop loss levels are typically placed below support or resistance areas, trend lines, or major moving averages.

The distance between the entry point and stop loss level should consider the trader’s account size, risk tolerance, and volatility of the asset being traded. Take profit levels can also be set using technical analysis tools such as Fibonacci retracements or chart patterns.

Traders may also choose to use trailing stops which automatically adjust the stop loss level as the market moves in their favor. Overall, setting appropriate stop loss and take profit levels is crucial for managing risk and maximizing profits in trading activities.

Tips for Maximizing Your Results

Maximizing results in trading requires a comprehensive understanding of the market and strategic decision-making based on reliable data and analysis. Trading psychology plays a crucial role in determining one’s success in the financial markets.

One must have a rational mindset that enables them to make informed decisions regardless of market conditions. Fear, greed, and impatience are some common psychological barriers that traders must overcome to avoid making irrational judgments.

Risk management is another critical component of maximizing results while using the patterns v7 indicator for MT4. Traders should always consider their risk tolerance levels before entering any trade.

It is advisable to use stop-loss orders as they limit potential losses by automatically closing positions when prices move against you. Setting realistic profit targets can also help manage risk by controlling emotions such as greed or fear of missing out (FOMO). Proper implementation of trading strategies coupled with effective risk management techniques can improve one’s chances of achieving consistent profits over time.

Conclusion

In conclusion, the 123 Patterns V7 Indicator can be a valuable tool for traders looking to identify potential trend reversals. This indicator is based on a simple pattern recognition concept and can help traders spot critical levels in the market.

By understanding how the indicator works and incorporating it into their trading strategy, traders may improve their chances of success. To maximize results when using this indicator, it is essential to combine it with other technical analysis tools and to thoroughly analyze market conditions before making any trades.

Additionally, it’s crucial to manage risk appropriately by setting stop-loss orders and taking profits at reasonable levels. With these tips in mind, traders can use the 123 Patterns V7 Indicator as part of a comprehensive trading approach that incorporates both technical indicators and fundamental analysis.