Retracement Finder Mt4 Indicator Review

The Retracement Finder MT4 Indicator is a technical analysis tool that helps traders identify potential retracements in price movements. Retracements are temporary reversals in the direction of a market trend, typically caused by profit-taking or corrective action. By identifying these retracements, traders can anticipate future price movements and make informed trading decisions.

Download Free Retracement Finder Mt4 Indicator

This indicator is widely used in forex trading, as well as other financial markets such as stocks and commodities. It has gained popularity among traders due to its ability to provide accurate signals for potential retracement levels.

In this article, we will delve into the details of the Retracement Finder MT4 Indicator and explore how it works, how to use it, and tips for incorporating it into your trading strategy.

What are Retracements?

The concept of retracements, or the temporary reversals in price movements, is a commonly discussed phenomenon in technical analysis. It is believed that market trends move in waves and that retracements are a natural part of this movement. These waves are often analyzed using Fibonacci levels, which refer to specific percentages that indicate where price has pulled back before continuing its trend.

Retracements provide valuable insights into potential entry or exit points for traders. By analyzing price action during a retracement, traders can determine whether the trend is likely to continue or reverse. There are various methods for identifying retracements such as trend lines and moving averages, but Fibonacci levels remain one of the most popular tools used by traders.

Understanding and utilizing these levels can help traders identify potential support and resistance levels where they can place trades with greater confidence.

Understanding the Retracement Finder MT4 Indicator

The Retracement Finder MT4 Indicator is a tool used for identifying potential retracements in financial markets. This discussion focuses on understanding how the indicator works, its features and benefits.

The objective of this topic is to provide traders with an accurate, detailed, and concise overview of the Retracement Finder MT4 Indicator.

How it Works

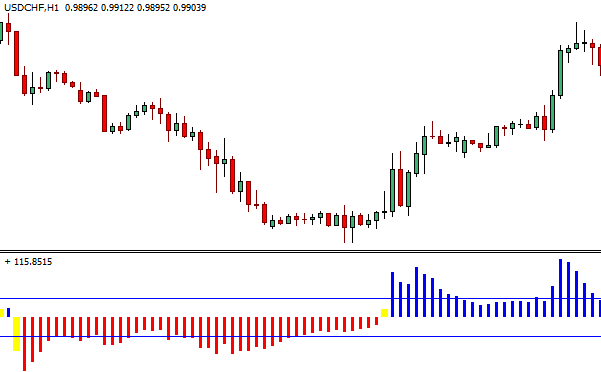

By understanding the underlying principles of price action and market psychology, traders can gain valuable insights into how the retracement finder mt4 indicator operates. This indicator uses Fibonacci levels to identify potential support and resistance levels in trading markets. Traders can then use this information to plan their entries and exits more effectively.

The mechanics of the retracement finder mt4 indicator are relatively straightforward. When a trader applies this indicator to a chart, it will automatically generate horizontal lines at key Fibonacci retracement levels. These levels are based on mathematical ratios that have been shown to occur frequently in financial markets.

By identifying areas of potential support or resistance, traders can make more informed decisions about where to enter or exit trades. Some strategies for maximizing the effectiveness of this tool include combining it with other indicators, using it in conjunction with price action analysis, and setting stop-loss orders at key support or resistance levels identified by the indicator.

Features and Benefits

This section highlights the features and benefits of a powerful tool that traders can leverage to gain a deeper understanding of market dynamics, thereby enabling them to make informed decisions that can potentially lead to increased profitability and success in trading.

The Retracement Finder MT4 Indicator is designed to identify key levels where price retracements are likely to occur. This powerful tool uses advanced algorithms and technical analysis techniques to generate accurate signals that help traders make more profitable trades.

One of the main benefits of using the Retracement Finder MT4 Indicator is that it helps traders identify high-probability trade setups. By analyzing price action and identifying key support and resistance levels, this indicator allows traders to enter trades with confidence, knowing they have a high probability of success.

Additionally, this indicator provides valuable insights into market trends and can help traders anticipate future price movements. Overall, the Retracement Finder MT4 Indicator offers significant advantages for both novice and experienced traders looking to improve their trading strategies and increase profitability.

How to Use the Retracement Finder MT4 Indicator

To effectively utilize the Retracement Finder MT4 Indicator, one must understand the step-by-step process and specific parameters involved in identifying retracements within an MT4 platform. Here are some tips and tricks on how to use the Retracement Finder MT4 Indicator:

- First, open a chart on your MT4 platform and select the currency pair you want to analyze.

- Next, add the Retracement Finder MT4 Indicator from your indicators list or download it if you haven’t already done so.

- Once added, adjust the settings of the indicator based on your preferences or trading strategy.

Maximizing profits with the Retracement Finder MT4 Indicator requires patience and discipline. It is important to wait for confirmation before entering a trade based on retracement signals.

Additionally, traders should also consider other technical analysis tools such as support and resistance levels, trendlines, and moving averages to confirm their findings before making any trades.

By combining these tools with proper risk management strategies, traders can increase their chances of success when using the Retracement Finder MT4 Indicator.

Tips for Incorporating the Retracement Finder MT4 Indicator into Your Trading Strategy

The section following will provide valuable tips and insights for traders on how to effectively incorporate the Retracement Finder MT4 Indicator into their overall trading strategy, with a focus on utilizing other technical analysis tools and implementing proper risk management practices.

One of the best practices for integrating the Retracement Finder MT4 Indicator is to combine it with other technical analysis tools such as moving averages, trend lines, and support/resistance levels. By doing so, traders can confirm potential retracement levels and make more informed trading decisions based on multiple sources of information.

Another important factor to consider when using the Retracement Finder MT4 Indicator is proper risk management. Traders should set stop-loss orders at appropriate levels based on their risk tolerance and ensure that they are not risking more than they are comfortable losing.

It is also recommended to use position sizing techniques such as fixed fractional or fixed percentage methods to limit exposure in any one trade. By incorporating these best practices along with the Retracement Finder MT4 Indicator into their trading strategy, traders can improve their chances of achieving consistent profits while minimizing potential losses.

Conclusion

Retracements are a common occurrence in financial markets and can provide traders with valuable insights into potential price movements. The Retracement Finder MT4 Indicator is a popular tool used by traders to identify these retracements, which can help them make informed trading decisions.

By understanding how the Retracement Finder MT4 Indicator works, traders can effectively use it to detect potential retracements and gauge their significance. Incorporating this indicator into one’s trading strategy can lead to more accurate predictions of future price movements and ultimately improve overall trading performance.

However, as with any technical tool, it is important for traders to approach the Retracement Finder MT4 Indicator with caution and not rely solely on its signals. By combining this indicator with other analysis techniques and market knowledge, traders can gain a greater edge in their trades.

Overall, the Retracement Finder MT4 Indicator is a useful tool for identifying potential retracements but should be used in conjunction with other indicators and analysis methods for optimal results.